Page 6 - Pakistan Oilfields Limited - Condensed Interim Financial Statements Six Months Period Ended December 31, 2023

P. 6

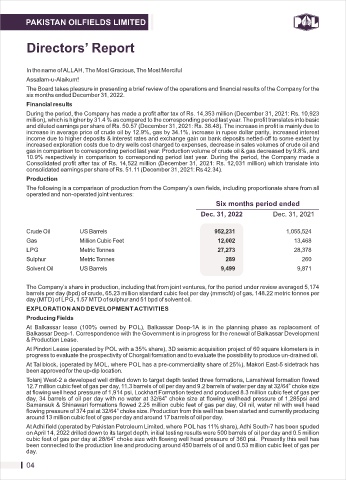

Directors’ Report

In the name of ALLAH, The Most Gracious, The Most Merciful

Assalam-u-Alaikum!

The Board takes pleasure in presenting a brief review of the operations and financial results of the Company for the

six months ended December 31, 2022.

Financial results

During the period, the Company has made a profit after tax of Rs. 14,353 million (December 31, 2021: Rs. 10,923

million), which is higher by 31.4 % as compared to the corresponding period last year. The profit translates into basic

and diluted earnings per share of Rs. 50.57 (December 31, 2021: Rs. 38.48). The increase in profit is mainly due to

increase in average price of crude oil by 12.9%, gas by 34.1%, increase in rupee dollar parity, increased interest

income due to higher deposits & interest rates and exchange gain on bank deposits netted-off to some extent by

increased exploration costs due to dry wells cost charged to expenses, decrease in sales volumes of crude oil and

gas in comparison to corresponding period last year. Production volume of crude oil & gas decreased by 9.8%, and

10.9% respectively in comparison to corresponding period last year. During the period, the Company made a

Consolidated profit after tax of Rs. 14,522 million (December 31, 2021: Rs. 12,031 million) which translate into

consolidated earnings per share of Rs. 51.11 (December 31, 2021: Rs 42.34).

Production

The following is a comparison of production from the Company’s own fields, including proportionate share from all

operated and non-operated joint ventures:

Six months period ended

Dec. 31, 2022 Dec. 31, 2021

Crude Oil US Barrels 952,231 1,055,524

Gas Million Cubic Feet 12,002 13,468

LPG Metric Tonnes 27,273 28,378

Sulphur Metric Tonnes 289 260

Solvent Oil US Barrels 9,499 9,871

The Company’s share in production, including that from joint ventures, for the period under review averaged 5,174

barrels per day (bpd) of crude, 65.23 million standard cubic feet per day (mmscfd) of gas, 148.22 metric tonnes per

day (MTD) of LPG, 1.57 MTD of sulphur and 51 bpd of solvent oil.

EXPLORATION AND DEVELOPMENT ACTIVITIES

Producing Fields

At Balkassar lease (100% owned by POL), Balkassar Deep-1A is in the planning phase as replacement of

Balkassar Deep-1. Correspondence with the Government is in progress for the renewal of Balkassar Development

& Production Lease.

At Pindori Lease (operated by POL with a 35% share), 3D seismic acquisition project of 60 square kilometers is in

progress to evaluate the prospectivity of Chorgali formation and to evaluate the possibility to produce un-drained oil.

At Tal block, (operated by MOL, where POL has a pre-commerciality share of 25%), Makori East-5 sidetrack has

been approved for the up-dip location.

Tolanj West-2 a developed well drilled down to target depth tested three formations, Lamshiwal formation flowed

12.7 million cubic feet of gas per day, 11.3 barrels of oil per day and 9.2 barrels of water per day at 32/64” choke size

at flowing well head pressure of 1,914 psi, Lockhart Formation tested and produced 8.3 million cubic feet of gas per

day, 34 barrels of oil per day with no water at 32/64” choke size at flowing wellhead pressure of 1,285psi and

Samansuk & Shinawari formations flowed 2.25 million cubic feet of gas per day, Oil nil, water nil with well head

flowing pressure of 374 psi at 32/64” choke size. Production from this well has been started and currently producing

around 13 million cubic feet of gas per day and around 17 barrels of oil per day.

At Adhi field (operated by Pakistan Petroleum Limited, where POL has 11% share), Adhi South-7 has been spuded

on April 14, 2022 drilled down to its target depth, initial testing results were 500 barrels of oil per day and 0.5 million

cubic feet of gas per day at 28/64” choke size with flowing well head pressure of 360 psi. Presently this well has

been connected to the production line and producing around 450 barrels of oil and 0.53 million cubic feet of gas per

day.

04