Page 5 - Interim Financial Report for three months period ended September 30, 2022

P. 5

Directors' Report

In the name of ALLAH, The Most Gracious, The Most Merciful

Assalam-u-Alaikum!

The Board takes pleasure in presenting a brief review of the operations and financial results of the

Company for the 1st quarter ended September 30, 2022.

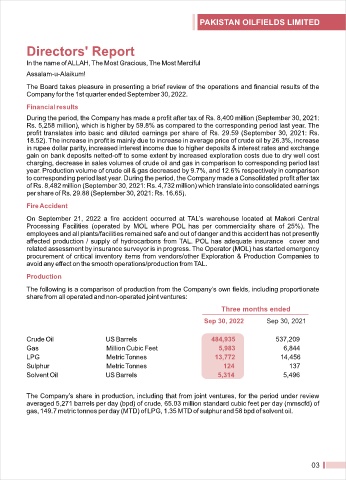

Financial results

During the period, the Company has made a profit after tax of Rs. 8,400 million (September 30, 2021:

Rs. 5,258 million), which is higher by 59.8% as compared to the corresponding period last year. The

profit translates into basic and diluted earnings per share of Rs. 29.59 (September 30, 2021: Rs.

18.52). The increase in profit is mainly due to increase in average price of crude oil by 26.3%, increase

in rupee dollar parity, increased interest income due to higher deposits & interest rates and exchange

gain on bank deposits netted-off to some extent by increased exploration costs due to dry well cost

charging, decrease in sales volumes of crude oil and gas in comparison to corresponding period last

year. Production volume of crude oil & gas decreased by 9.7%, and 12.6% respectively in comparison

to corresponding period last year. During the period, the Company made a Consolidated profit after tax

of Rs. 8,482 million (September 30, 2021: Rs. 4,732 million) which translate into consolidated earnings

per share of Rs. 29.88 (September 30, 2021: Rs. 16.65).

Fire Accident

On September 21, 2022 a fire accident occurred at TAL’s warehouse located at Makori Central

Processing Facilities (operated by MOL where POL has per commerciality share of 25%). The

employees and all plants/facilities remained safe and out of danger and this accident has not presently

affected production / supply of hydrocarbons from TAL. POL has adequate insurance cover and

related assessment by insurance surveyor is in progress. The Operator (MOL) has started emergency

procurement of critical inventory items from vendors/other Exploration & Production Companies to

avoid any effect on the smooth operations/production from TAL.

Production

The following is a comparison of production from the Company’s own fields, including proportionate

share from all operated and non-operated joint ventures:

Three months ended

Sep 30, 2022 Sep 30, 2021

Crude Oil US Barrels 484,935 537,209

Gas Million Cubic Feet 5,983 6,844

LPG Metric Tonnes 13,772 14,456

Sulphur Metric Tonnes 124 137

Solvent Oil US Barrels 5,314 5,496

The Company’s share in production, including that from joint ventures, for the period under review

averaged 5,271 barrels per day (bpd) of crude, 65.03 million standard cubic feet per day (mmscfd) of

gas, 149.7 metric tonnes per day (MTD) of LPG, 1.35 MTD of sulphur and 58 bpd of solvent oil.

03