Page 116 - Pakistan Oilfields Limited - Annual Report 2021

P. 116

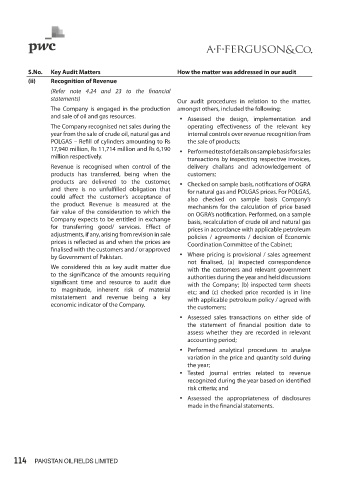

S.No. Key Audit Matters How the matter was addressed in our audit

(ii) Recognition of Revenue

(Refer note 4.24 and 23 to the financial

statements) Our audit procedures in relation to the matter,

The Company is engaged in the production amongst others, included the following:

and sale of oil and gas resources. • Assessed the design, implementation and

The Company recognised net sales during the operating effectiveness of the relevant key

year from the sale of crude oil, natural gas and internal controls over revenue recognition from

POLGAS – Refill of cylinders amounting to Rs the sale of products;

17,940 million, Rs 11,714 million and Rs 6,190 • Performed test of details on sample basis for sales

million respectively. transactions by inspecting respective invoices,

Revenue is recognised when control of the delivery challans and acknowledgement of

products has transferred, being when the customers;

products are delivered to the customer, • Checked on sample basis, notifications of OGRA

and there is no unfulfilled obligation that for natural gas and POLGAS prices. For POLGAS,

could affect the customer’s acceptance of also checked on sample basis Company’s

the product. Revenue is measured at the mechanism for the calculation of price based

fair value of the consideration to which the on OGRA’s notification. Performed, on a sample

Company expects to be entitled in exchange basis, recalculation of crude oil and natural gas

for transferring good/ services. Effect of prices in accordance with applicable petroleum

adjustments, if any, arising from revision in sale policies / agreements / decision of Economic

prices is reflected as and when the prices are Coordination Committee of the Cabinet;

finalised with the customers and / or approved

by Government of Pakistan. • Where pricing is provisional / sales agreement

not finalised, (a) inspected correspondence

We considered this as key audit matter due with the customers and relevant government

to the significance of the amounts requiring authorities during the year and held discussions

significant time and resource to audit due with the Company; (b) inspected term sheets

to magnitude, inherent risk of material etc; and (c) checked price recorded is in line

misstatement and revenue being a key with applicable petroleum policy / agreed with

economic indicator of the Company. the customers;

• Assessed sales transactions on either side of

the statement of financial position date to

assess whether they are recorded in relevant

accounting period;

• Performed analytical procedures to analyse

variation in the price and quantity sold during

the year;

• Tested journal entries related to revenue

recognized during the year based on identified

risk criteria; and

• Assessed the appropriateness of disclosures

made in the financial statements.

114 PAKISTAN OILFIELDS LIMITED