Page 87 - Pakistan Oilfields Limited - Annual Report 2021

P. 87

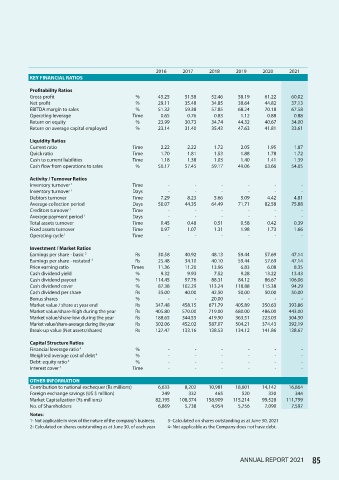

2016 2017 2018 2019 2020 2021

KEY FINANCIAL RATIOS

Profitability Ratios

Gross profit % 45.25 51.58 52.46 58.19 61.22 60.02

Net profit % 29.11 35.48 34.85 38.64 44.82 37.13

EBITDA margin to sales % 51.32 59.38 57.85 68.24 70.18 67.58

Operating leverage Time 0.65 0.76 0.83 1.12 0.88 0.88

Return on equity % 23.99 30.73 34.74 44.32 40.67 34.00

Return on average capital employed % 23.14 31.40 35.43 47.63 41.81 33.61

Liquidity Ratios

Current ratio Time 2.22 2.22 1.72 2.05 1.95 1.87

Quick ratio Time 1.70 1.81 1.53 1.88 1.78 1.72

Cash to current liabilities Time 1.18 1.38 1.03 1.40 1.41 1.39

Cash flow from operations to sales % 50.17 57.45 59.17 49.06 63.66 54.05

Activity / Turnover Ratios

Inventory turnover 1 Time - - - - - -

Inventory turnover 1 Days - - - - - -

Debtors turnover Time 7.29 8.23 5.66 5.09 4.42 4.81

Average collection period Days 50.07 44.35 64.49 71.71 82.58 75.88

Creditors turnover 1 Time - - - - - -

Average payment period 1 Days - - - - - -

Total assets turnover Time 0.45 0.48 0.51 0.58 0.42 0.39

Fixed assets turnover Time 0.97 1.07 1.31 1.98 1.73 1.66

Operating cycle 1 Time - - - - - -

Investment / Market Ratios

Earnings per share - basic 2 Rs 30.58 40.92 48.13 59.44 57.69 47.14

Earnings per share - restated 3 Rs 25.48 34.10 40.10 59.44 57.69 47.14

Price earning ratio Times 11.36 11.20 13.96 6.83 6.08 8.35

Cash dividend yield % 9.32 9.93 7.52 9.28 13.22 13.43

Cash dividend payout % 114.45 97.76 88.31 84.12 86.67 106.06

Cash dividend cover % 87.38 102.29 113.24 118.88 115.38 94.29

Cash dividend per share Rs 35.00 40.00 42.50 50.00 50.00 50.00

Bonus shares % - - 20.00 - - -

Market value / share at year end Rs 347.48 458.15 671.79 405.89 350.63 393.86

Market value/share-high during the year Rs 405.80 570.00 719.00 680.00 486.00 443.00

Market value/share-low during the year Rs 188.65 344.55 419.90 363.51 223.03 304.50

Market value/share-average during the year Rs 302.06 452.02 587.07 504.21 374.43 392.19

Break-up value (Net assets/shares) Rs 127.47 133.16 138.53 134.12 141.86 138.67

Capital Structure Ratios

Financial leverage ratio 4 % - - - - - -

Weighted average cost of debt 4 % - - - - - -

Debt: equity ratio 4 % - - - - - -

Interest cover 4 Time - - - - - -

OTHER INFORMATION

Contribution to national exchequer (Rs millions) 6,633 8,202 10,981 18,601 14,142 16,864

Foreign exchange savings (US $ million) 249 332 465 520 320 344

Market Capitalization (Rs millions) 82,195 108,374 158,909 115,214 99,528 111,799

No. of Shareholders 6,869 5,738 4,954 5,756 7,090 7,597

Notes:

1- Not applicable in view of the nature of the company's business. 3- Calculated on shares outstanding as at June 30, 2021

2- Calculated on shares outstanding as at June 30, of each year 4- Not applicable as the Company does not have debt.

ANNUAL REPORT 2021 85