Page 207 - Pakistan Oilfield Limited - Annual Report 2022

P. 207

205

Annual Report 2022

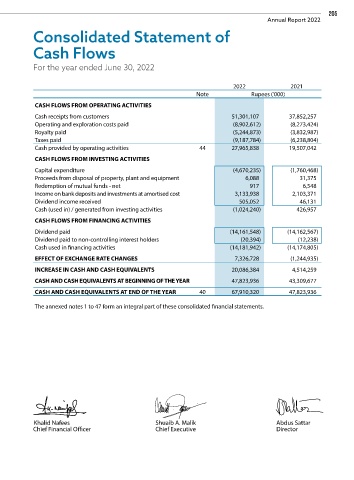

Consolidated Statement of

Cash Flows

For the year ended June 30, 2022

2022 2021

Note Rupees ('000)

CASH FLOWS FROM OPERATING ACTIVITIES

Cash receipts from customers 51,301,107 37,852,257

Operating and exploration costs paid (8,902,612) (8,273,424)

Royalty paid (5,244,873) (3,832,987)

Taxes paid (9,187,784) (6,238,804)

Cash provided by operating activities 44 27,965,838 19,507,042

CASH FLOWS FROM INVESTING ACTIVITIES

Capital expenditure (4,670,235) (1,760,468)

Proceeds from disposal of property, plant and equipment 6,088 31,375

Redemption of mutual funds - net 917 6,548

Income on bank deposits and investments at amortised cost 3,133,938 2,103,371

Dividend income received 505,052 46,131

Cash (used in) / generated from investing activities (1,024,240) 426,957

CASH FLOWS FROM FINANCING ACTIVITIES

Dividend paid (14,161,548) (14,162,567)

Dividend paid to non-controlling interest holders (20,394) (12,238)

Cash used in financing activities (14,181,942) (14,174,805)

EFFECT OF EXCHANGE RATE CHANGES 7,326,728 (1,244,935)

INCREASE IN CASH AND CASH EQUIVALENTS 20,086,384 4,514,259

CASH AND CASH EQUIVALENTS AT BEGINNING OF THE YEAR 47,823,936 43,309,677

CASH AND CASH EQUIVALENTS AT END OF THE YEAR 40 67,910,320 47,823,936

The annexed notes 1 to 47 form an integral part of these consolidated financial statements.

Khalid Nafees Shuaib A. Malik Abdus Sattar

Chief Financial Officer Chief Executive Director