Page 243 - Pakistan Oilfield Limited - Annual Report 2022

P. 243

241

Annual Report 2022

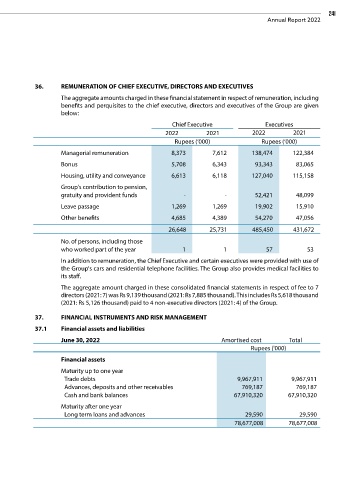

36. REMUNERATION OF CHIEF EXECUTIVE, DIRECTORS AND EXECUTIVES

The aggregate amounts charged in these financial statement in respect of remuneration, including

benefits and perquisites to the chief executive, directors and executives of the Group are given

below:

Chief Executive Executives

2022 2021 2022 2021

Rupees (‘000) Rupees (‘000)

Managerial remuneration 8,373 7,612 138,474 122,384

Bonus 5,708 6,343 93,343 83,065

Housing, utility and conveyance 6,613 6,118 127,040 115,158

Group's contribution to pension,

gratuity and provident funds - - 52,421 48,099

Leave passage 1,269 1,269 19,902 15,910

Other benefits 4,685 4,389 54,270 47,056

26,648 25,731 485,450 431,672

No. of persons, including those

who worked part of the year 1 1 57 53

In addition to remuneration, the Chief Executive and certain executives were provided with use of

the Group's cars and residential telephone facilities. The Group also provides medical facilities to

its staff.

The aggregate amount charged in these consolidated financial statements in respect of fee to 7

directors (2021: 7) was Rs 9,139 thousand (2021: Rs 7,885 thousand). This includes Rs 5,618 thousand

(2021: Rs 5,126 thousand) paid to 4 non-executive directors (2021: 4) of the Group.

37. FINANCIAL INSTRUMENTS AND RISK MANAGEMENT

37.1 Financial assets and liabilities

June 30, 2022 Amortised cost Total

Rupees ('000)

Financial assets

Maturity up to one year

Trade debts 9,967,911 9,967,911

Advances, deposits and other receivables 769,187 769,187

Cash and bank balances 67,910,320 67,910,320

Maturity after one year

Long term loans and advances 29,590 29,590

78,677,008 78,677,008