Page 18 - Condensed Interim Financial Statements - September 2023

P. 18

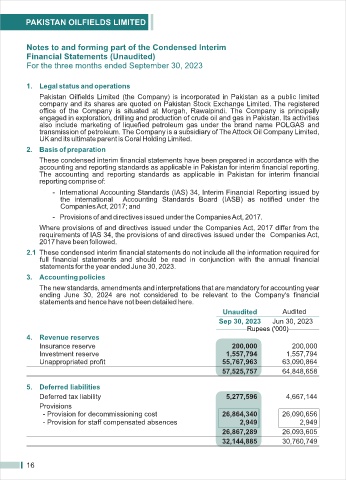

Notes to and forming part of the Condensed Interim

Financial Statements (Unaudited)

For the three months ended September 30, 2023

1. Legal status and operations

Pakistan Oilfields Limited (the Company) is incorporated in Pakistan as a public limited

company and its shares are quoted on Pakistan Stock Exchange Limited. The registered

office of the Company is situated at Morgah, Rawalpindi. The Company is principally

engaged in exploration, drilling and production of crude oil and gas in Pakistan. Its activities

also include marketing of liquefied petroleum gas under the brand name POLGAS and

transmission of petroleum. The Company is a subsidiary of The Attock Oil Company Limited,

UK and its ultimate parent is Coral Holding Limited.

2. Basis of preparation

These condensed interim financial statements have been prepared in accordance with the

accounting and reporting standards as applicable in Pakistan for interim financial reporting.

The accounting and reporting standards as applicable in Pakistan for interim financial

reporting comprise of:

- International Accounting Standards (IAS) 34, Interim Financial Reporting issued by

the international Accounting Standards Board (IASB) as notified under the

Companies Act, 2017; and

- Provisions of and directives issued under the Companies Act, 2017.

Where provisions of and directives issued under the Companies Act, 2017 differ from the

requirements of IAS 34, the provisions of and directives issued under the Companies Act,

2017 have been followed.

2.1 These condensed interim financial statements do not include all the information required for

full financial statements and should be read in conjunction with the annual financial

statements for the year ended June 30, 2023.

3. Accounting policies

The new standards, amendments and interpretations that are mandatory for accounting year

ending June 30, 2024 are not considered to be relevant to the Company's financial

statements and hence have not been detailed here.

Unaudited Audited

Sep 30, 2023 Jun 30, 2023

Rupees ('000)

4. Revenue reserves

Insurance reserve 200,000 200,000

Investment reserve 1,557,794 1,557,794

Unappropriated profit 55,767,963 63,090,864

57,525,757 64,848,658

5. Deferred liabilities

Deferred tax liability 5,277,596 4,667,144

Provisions

- Provision for decommissioning cost 26,864,340 26,090,656

- Provision for staff compensated absences 2,949 2,949

26,867,289 26,093,605

32,144,885 30,760,749

16