Page 143 - Pakistan Oilfields Limited - Annual Report 2021

P. 143

NOTES TO AND FORMING

PART OF THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2021

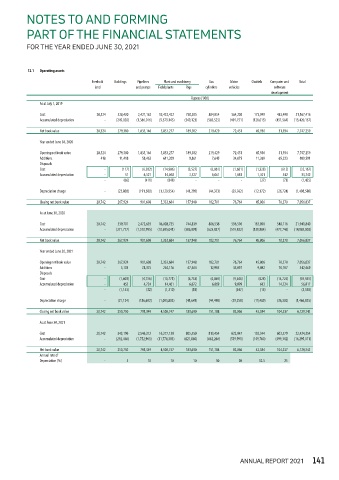

12.1 Operating assets

Freehold Buildings Pipelines Plant and machinery Gas Motor Chattels Computer and Total

land and pumps Field plants Rigs cylinders vehicles software

development

Rupees ('000)

As at July 1, 2019

Cost 20,324 528,400 2,421,162 15,432,422 738,505 804,954 564,202 173,949 483,498 21,167,416

Accumulated depreciation - (249,020) (1,386,016) (9,579,145) (549,123) (585,525) (491,751) (128,013) (451,564) (13,420,157)

Net book value 20,324 279,380 1,035,146 5,853,277 189,382 219,429 72,451 45,936 31,934 7,747,259

Year ended June 30, 2020

Opening net book value 20,324 279,380 1,035,146 5,853,277 189,382 219,429 72,451 45,936 31,934 7,747,259

Additions 418 11,418 58,463 611,209 9,861 7,645 34,075 11,269 65,233 809,591

Disposals

Cost - (117) (6,932) (14,906) (3,527) (6,061) (1,681) (1,328) (615) (35,167)

Accumulated depreciation - 51 6,521 14,058 3,527 6,061 1,681 1,301 542 33,742

- (66) (411) (848) - - - (27) (73) (1,425)

Depreciation charge - (22,808) (191,500) (1,129,954) (41,295) (44,373) (29,762) (12,172) (26,724) (1,498,588)

Closing net book value 20,742 267,924 901,698 5,333,684 157,948 182,701 76,764 45,006 70,370 7,056,837

As at June 30, 2020

Cost 20,742 539,701 2,472,693 16,028,725 744,839 806,538 596,596 183,890 548,116 21,941,840

Accumulated depreciation - (271,777) (1,570,995) (10,695,041) (586,891) (623,837) (519,832) (138,884) (477,746) (14,885,003)

Net book value 20,742 267,924 901,698 5,333,684 157,948 182,701 76,764 45,006 70,370 7,056,837

Year ended June 30, 2021

Opening net book value 20,742 267,924 901,698 5,333,684 157,948 182,701 76,764 45,006 70,370 7,056,837

Additions - 5,103 78,375 264,176 67,464 12,985 35,097 9,082 70,187 542,469

Disposals

Cost - (1,608) (4,756) (15,771) (6,753) (6,069) (9,646) (628) (14,724) (59,955)

Accumulated depreciation - 455 4,724 14,461 6,672 6,069 9,099 613 14,724 56,817

- (1,153) (32) (1,310) (81) - (547) (15) - (3,138)

Depreciation charge - (21,124) (186,692) (1,095,803) (41,641) (44,498) (29,258) (11,489) (36,320) (1,466,825)

Closing net book value 20,742 250,750 793,349 4,500,747 183,690 151,188 82,056 42,584 104,237 6,129,343

As at June 30, 2021

Cost 20,742 543,196 2,546,312 16,277,130 805,550 813,454 622,047 192,344 603,579 22,424,354

Accumulated depreciation - (292,446) (1,752,963) (11,776,383) (621,860) (662,266) (539,991) (149,760) (499,342) (16,295,011)

Net book value 20,742 250,750 793,349 4,500,747 183,690 151,188 82,056 42,584 104,237 6,129,343

Annual rate of

Depreciation (%) - 5 10 10 10 10 20 12.5 25

ANNUAL REPORT 2021 141