Page 140 - Pakistan Oilfields Limited - Annual Report 2021

P. 140

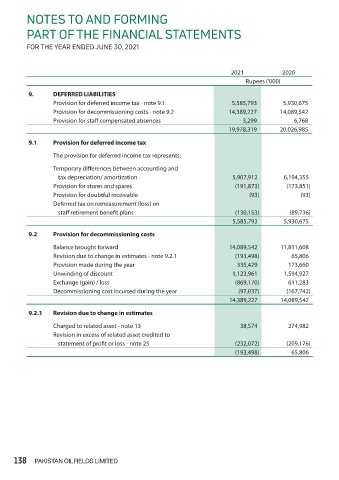

NOTES TO AND FORMING

PART OF THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2021

2021 2020

Rupees ('000)

9. DEFERRED LIABILITIES

Provision for deferred income tax - note 9.1 5,585,793 5,930,675

Provision for decommissioning costs - note 9.2 14,389,227 14,089,542

Provision for staff compensated absences 3,299 6,768

19,978,319 20,026,985

9.1 Provision for deferred income tax

The provision for deferred income tax represents:

Temporary differences between accounting and

tax depreciation/ amortization 5,907,912 6,194,355

Provision for stores and spares (191,873) (173,851)

Provision for doubtful receivable (93) (93)

Deferred tax on remeasurement (loss) on

staff retirement benefit plans (130,153) (89,736)

5,585,793 5,930,675

9.2 Provision for decommissioning costs

Balance brought forward 14,089,542 11,811,608

Revision due to change in estimates - note 9.2.1 (193,498) 65,806

Provision made during the year 335,429 173,660

Unwinding of discount 1,123,961 1,594,927

Exchange (gain) / loss (869,170) 611,283

Decommissioning cost incurred during the year (97,037) (167,742)

14,389,227 14,089,542

9.2.1 Revision due to change in estimates

Charged to related asset - note 13 38,574 274,982

Revision in excess of related asset credited to

statement of profit or loss - note 25 (232,072) (209,176)

(193,498) 65,806

138 PAKISTAN OILFIELDS LIMITED