Page 173 - Pakistan Oilfields Limited - Annual Report 2021

P. 173

NOTES TO AND FORMING

PART OF THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2021

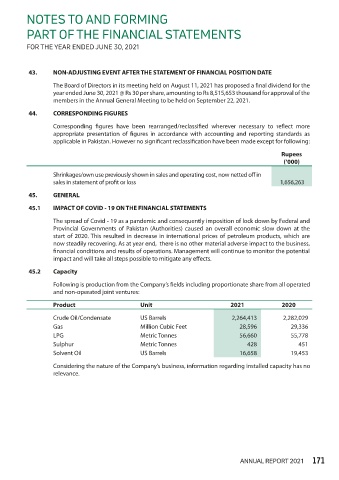

43. NON-ADJUSTING EVENT AFTER THE STATEMENT OF FINANCIAL POSITION DATE

The Board of Directors in its meeting held on August 11, 2021 has proposed a final dividend for the

year ended June 30, 2021 @ Rs 30 per share, amounting to Rs 8,515,653 thousand for approval of the

members in the Annual General Meeting to be held on September 22, 2021.

44. CORRESPONDING FIGURES

Corresponding figures have been rearranged/reclassified wherever necessary to reflect more

appropriate presentation of figures in accordance with accounting and reporting standards as

applicable in Pakistan. However no significant reclassification have been made except for following:

Rupees

(‘000)

Shrinkages/own use previously shown in sales and operating cost, now netted off in

sales in statement of profit or loss 1,656,263

45. GENERAL

45.1 IMPACT OF COVID - 19 ON THE FINANCIAL STATEMENTS

The spread of Covid - 19 as a pandemic and consequently imposition of lock down by Federal and

Provincial Governments of Pakistan (Authorities) caused an overall economic slow down at the

start of 2020. This resulted in decrease in international prices of petroleum products, which are

now steadily recovering. As at year end, there is no other material adverse impact to the business,

financial conditions and results of operations. Management will continue to monitor the potential

impact and will take all steps possible to mitigate any effects.

45.2 Capacity

Following is production from the Company’s fields including proportionate share from all operated

and non-operated joint ventures:

Product Unit 2021 2020

Crude Oil/Condensate US Barrels 2,264,413 2,282,029

Gas Million Cubic Feet 28,596 29,336

LPG Metric Tonnes 56,660 55,778

Sulphur Metric Tonnes 428 451

Solvent Oil US Barrels 16,658 19,453

Considering the nature of the Company’s business, information regarding installed capacity has no

relevance.

ANNUAL REPORT 2021 171