Page 104 - Pakistan Oilfield Limited - Annual Report 2022

P. 104

102

PAKISTAN OILFIELDS LIMITED

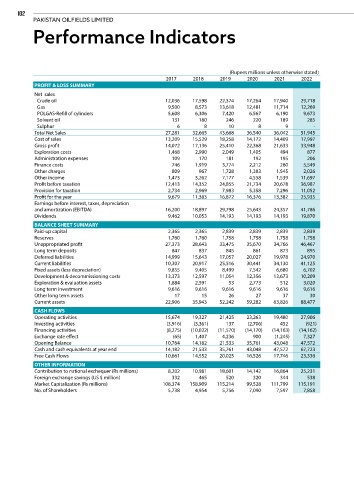

Performance Indicators

(Rupees millions unless otherwise stated)

2017 2018 2019 2020 2021 2022

PROFIT & LOSS SUMMARY

Net sales

Crude oil 12,036 17,598 22,374 17,264 17,940 29,718

Gas 9,500 8,573 13,618 12,481 11,714 12,269

POLGAS-Refill of cylinders 5,608 6,306 7,420 6,567 6,190 9,673

Solvent oil 131 180 246 220 189 285

Sulphur 6 8 10 8 9 -

Total Net Sales 27,281 32,665 43,668 36,540 36,042 51,945

Cost of sales 13,209 15,529 18,258 14,172 14,409 17,997

Gross profit 14,072 17,136 25,410 22,368 21,633 33,948

Exploration costs 1,468 2,990 2,049 1,405 494 877

Administration expenses 109 170 181 192 195 206

Finance costs 746 1,919 3,774 2,212 260 5,549

Other charges 809 967 1,728 1,383 1,545 2,026

Other income 1,473 3,262 7,177 4,558 1,539 11,697

Profit before taxation 12,413 14,352 24,855 21,734 20,678 36,987

Provision for taxation 2,734 2,969 7,983 5,358 7,296 11,052

Profit for the year 9,679 11,383 16,872 16,376 13,382 25,935

Earnings before interest, taxes, depreciation

and amortization (EBITDA) 16,200 18,897 29,798 25,643 24,357 41,786

Dividends 9,462 10,053 14,193 14,193 14,193 19,870

BALANCE SHEET SUMMARY

Paid-up capital 2,365 2,365 2,839 2,839 2,839 2,839

Reserves 1,760 1,760 1,758 1,758 1,758 1,758

Unappropriated profit 27,373 28,643 33,475 35,670 34,766 46,467

Long term deposits 847 837 845 861 873 895

Deferred liabilities 14,999 15,643 17,057 20,027 19,978 24,970

Current liabilities 10,307 20,917 25,516 30,441 34,130 41,125

Fixed assets (less depreciation) 9,855 9,405 8,499 7,542 6,680 6,702

Development & decommissioning costs 13,373 12,597 11,054 12,356 13,673 10,209

Exploration & evaluation assets 1,884 2,591 53 2,773 512 3,020

Long term investment 9,616 9,616 9,616 9,616 9,616 9,616

Other long term assets 17 15 26 27 37 30

Current assets 22,906 35,943 52,242 59,282 63,826 88,477

CASH FLOWS

Operating activities 15,674 19,327 21,425 23,263 19,480 27,906

Investing activities (3,916) (3,361) 137 (2,706) 452 (921)

Financing activities (8,275) (10,022) (11,570) (14,170) (14,163) (14,162)

Exchange rate effect (65) 1,407 4,236 900 (1,245) 7,327

Opening Balance 10,764 14,182 21,533 35,761 43,048 47,572

Cash and cash equivalents at year end 14,182 21,533 35,761 43,048 47,572 67,723

Free Cash Flows 10,661 14,552 20,025 16,526 17,746 23,336

OTHER INFORMATION

Contribution to national exchequer (Rs millions) 8,202 10,981 18,601 14,142 16,864 25,231

Foreign exchange savings (US $ million) 332 465 520 320 344 538

Market Capitalization (Rs millions) 108,374 158,909 115,214 99,528 111,799 115,191

No. of Shareholders 5,738 4,954 5,756 7,090 7,597 7,858