Page 199 - Pakistan Oilfield Limited - Annual Report 2022

P. 199

197

Annual Report 2022

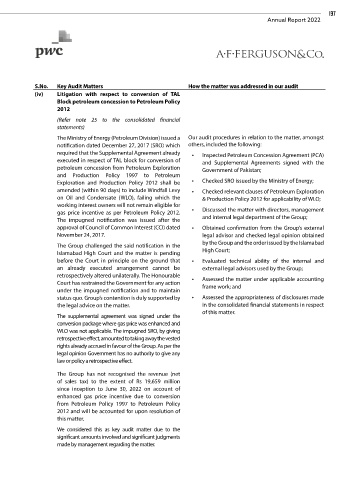

S.No. Key Audit Matters How the matter was addressed in our audit

(iv) Litigation with respect to conversion of TAL

Block petroleum concession to Petroleum Policy

2012

(Refer note 25 to the consolidated financial

statements)

The Ministry of Energy (Petroleum Division) issued a Our audit procedures in relation to the matter, amongst

notification dated December 27, 2017 (SRO) which others, included the following:

required that the Supplemental Agreement already • Inspected Petroleum Concession Agreement (PCA)

executed in respect of TAL block for conversion of and Supplemental Agreements signed with the

petroleum concession from Petroleum Exploration Government of Pakistan;

and Production Policy 1997 to Petroleum

Exploration and Production Policy 2012 shall be • Checked SRO issued by the Ministry of Energy;

amended (within 90 days) to include Windfall Levy • Checked relevant clauses of Petroleum Exploration

on Oil and Condensate (WLO), failing which the & Production Policy 2012 for applicability of WLO;

working interest owners will not remain eligible for

gas price incentive as per Petroleum Policy 2012. • Discussed the matter with directors, management

The impugned notification was issued after the and internal legal department of the Group;

approval of Council of Common Interest (CCI) dated • Obtained confirmation from the Group’s external

November 24, 2017. legal advisor and checked legal opinion obtained

The Group challenged the said notification in the by the Group and the order issued by the Islamabad

Islamabad High Court and the matter is pending High Court;

before the Court in principle on the ground that • Evaluated technical ability of the internal and

an already executed arrangement cannot be external legal advisors used by the Group;

retrospectively altered unilaterally. The Honourable

Court has restrained the Government for any action • Assessed the matter under applicable accounting

under the impugned notification and to maintain frame work; and

status quo. Group’s contention is duly supported by • Assessed the appropriateness of disclosures made

the legal advice on the matter. in the consolidated financial statements in respect

of this matter.

The supplemental agreement was signed under the

conversion package where gas price was enhanced and

WLO was not applicable. The impugned SRO, by giving

retrospective effect, amounted to taking away the vested

rights already accrued in favour of the Group. As per the

legal opinion Government has no authority to give any

law or policy a retrospective effect.

The Group has not recognised the revenue (net

of sales tax) to the extent of Rs 19,659 million

since inception to June 30, 2022 on account of

enhanced gas price incentive due to conversion

from Petroleum Policy 1997 to Petroleum Policy

2012 and will be accounted for upon resolution of

this matter.

We considered this as key audit matter due to the

significant amounts involved and significant judgments

made by management regarding the matter.