Page 222 - Pakistan Oilfield Limited - Annual Report 2022

P. 222

220

PAKISTAN OILFIELDS LIMITED

Notes to and Forming Part of the -

Consolidated Financial Statements

For the year ended June 30, 2022

2022 2021

Rupees ('000)

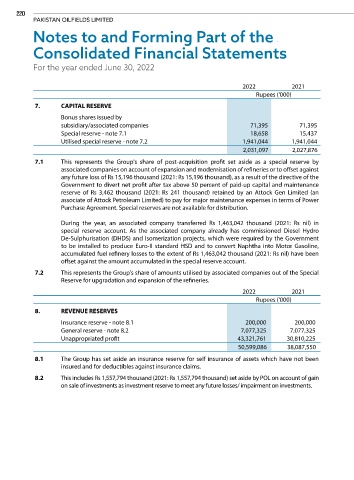

7. CAPITAL RESERVE

Bonus shares issued by

subsidiary/associated companies 71,395 71,395

Special reserve - note 7.1 18,658 15,437

Utilised special reserve - note 7.2 1,941,044 1,941,044

2,031,097 2,027,876

7.1 This represents the Group's share of post-acquisition profit set aside as a special reserve by

associated companies on account of expansion and modernisation of refineries or to offset against

any future loss of Rs 15,196 thousand (2021: Rs 15,196 thousand), as a result of the directive of the

Government to divert net profit after tax above 50 percent of paid-up capital and maintenance

reserve of Rs 3,462 thousand (2021: Rs 241 thousand) retained by an Attock Gen Limited (an

associate of Attock Petroleum Limited) to pay for major maintenance expenses in terms of Power

Purchase Agreement. Special reserves are not available for distribution.

During the year, an associated company transferred Rs 1,463,042 thousand (2021: Rs nil) in

special reserve account. As the associated company already has commissioned Diesel Hydro

De-Sulphurisation (DHDS) and Isomerization projects, which were required by the Government

to be installed to produce Euro-II standard HSD and to convert Naphtha into Motor Gasoline,

accumulated fuel refinery losses to the extent of Rs 1,463,042 thousand (2021: Rs nil) have been

offset against the amount accumulated in the special reserve account.

7.2 This represents the Group's share of amounts utilised by associated companies out of the Special

Reserve for upgradation and expansion of the refineries.

2022 2021

Rupees ('000)

8. REVENUE RESERVES

Insurance reserve - note 8.1 200,000 200,000

General reserve - note 8.2 7,077,325 7,077,325

Unappropriated profit 43,321,761 30,810,225

50,599,086 38,087,550

8.1 The Group has set aside an insurance reserve for self insurance of assets which have not been

insured and for deductibles against insurance claims.

8.2 This includes Rs 1,557,794 thousand (2021: Rs 1,557,794 thousand) set aside by POL on account of gain

on sale of investments as investment reserve to meet any future losses/ impairment on investments.