Page 223 - Pakistan Oilfield Limited - Annual Report 2022

P. 223

221

Annual Report 2022

2022 2021

Rupees ('000)

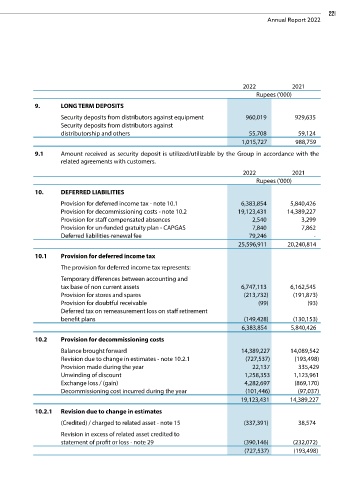

9. LONG TERM DEPOSITS

Security deposits from distributors against equipment 960,019 929,635

Security deposits from distributors against

distributorship and others 55,708 59,124

1,015,727 988,759

9.1 Amount received as security deposit is utilized/utilizable by the Group in accordance with the

related agreements with customers.

2022 2021

Rupees ('000)

10. DEFERRED LIABILITIES

Provision for deferred income tax - note 10.1 6,383,854 5,840,426

Provision for decommissioning costs - note 10.2 19,123,431 14,389,227

Provision for staff compensated absences 2,540 3,299

Provision for un-funded gratuity plan - CAPGAS 7,840 7,862

Deferred liabilities-renewal fee 79,246 -

25,596,911 20,240,814

10.1 Provision for deferred income tax

The provision for deferred income tax represents:

Temporary differences between accounting and

tax base of non current assets 6,747,113 6,162,545

Provision for stores and spares (213,732) (191,873)

Provision for doubtful receivable (99) (93)

Deferred tax on remeasurement loss on staff retirement

benefit plans (149,428) (130,153)

6,383,854 5,840,426

10.2 Provision for decommissioning costs

Balance brought forward 14,389,227 14,089,542

Revision due to change in estimates - note 10.2.1 (727,537) (193,498)

Provision made during the year 22,137 335,429

Unwinding of discount 1,258,353 1,123,961

Exchange loss / (gain) 4,282,697 (869,170)

Decommissioning cost incurred during the year (101,446) (97,037)

19,123,431 14,389,227

10.2.1 Revision due to change in estimates

(Credited) / charged to related asset - note 15 (337,391) 38,574

Revision in excess of related asset credited to

statement of profit or loss - note 29 (390,146) (232,072)

(727,537) (193,498)