Page 103 - Pakistan Oilfields Limited - Annual Report 2021

P. 103

Analysis of Analysis of variation in interim

Statement of results as compared to full year

Financial Position results

Non-Current Assets: Production volumes were higher in Q-1, Q-2, Q-3, as

compared to Q-4. The lower production in Q-4 was

During the year, the additions to Property, Plant mainly due to annual turnaround of MOL plants at CPF.

& Equipment were Rs 608 million (June 2020 Rs

543 million). Development and decommissioning Crude oil price showed an increasing trend during the

cost increased by Rs 1,317 million mainly due to year, Gas price showed increasing trend except Q-3

addition of Balkassar Deep (transferred from E&E), due to lower exchange rate and POLGAS price also

Jhandial and Mamikhel South. Further, amortization showed increasing trend except Q-4.

of development & decommissioning cost for the Net Sales decreased by 1.4% due to decrease in

year is Rs 2,444 million. production during the year. Cost of sales and taxation

were also increased during the period. The above

Non-Current Liabilities: increases were offset by decrease in exploration costs

Provision for deferred income tax decreased by Rs and other expenses. Other income also decrease by

345 million which is offset by increase in provision 66.2% due to lower mark-up rates and exchange loss

for decommissioning costs by Rs 300 million. on foreign currency balances. Profit after tax Rs 13,382

million (2020: Rs 16,376 million)

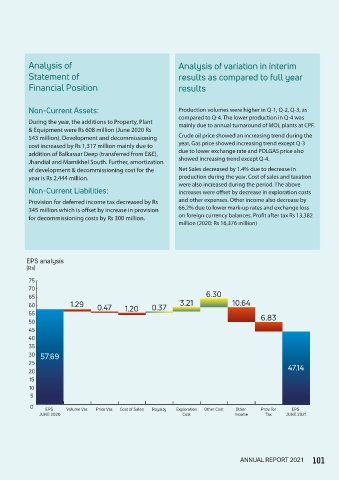

EPS analysis

(Rs)

75

70

65 6.30

60 1.29 0.47 1.20 0.37 3.21 10.64

55 6.83

50

45

40

35

30 57.69

25

20 47.14

15

10

5

0 EPS Volume Var. Price Var. Cost of Sales Royalty Exploration Other Cost Other Prov. for EPS

JUNE 2020 Cost Income Tax JUNE 2021

ANNUAL REPORT 2021 101