Page 99 - Pakistan Oilfields Limited - Annual Report 2021

P. 99

100.00% 120.00% 100.00% 100.00% 133.60% 131.40% 0.00% 130.50% 105.10% 127.80% 126.60% 462.90% 231.00% 375.20% 169.30% 64.10% 93.75% 56.83% 80.54% 100.00% 308.33% 109.96% 73.94% 219.99% 271.79% 0.00% 0.00% 441.95% 316.25% 169.33% 24.07%

% % 145.05% 105.91% 192.41% 230.00% 139.29% 25.44% 275.89% 116.14% 256.25% 109.07% 232.86% 443.26% 184.99% 156.25% -14.72% 149.97% -631.98% 441.95%

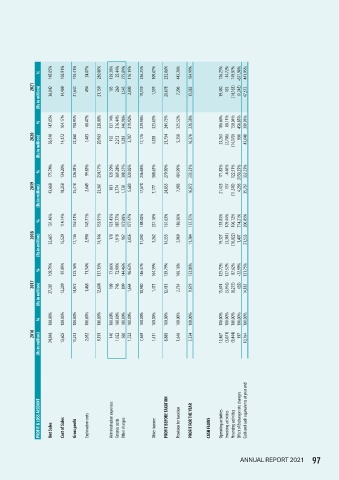

2021 5,000 2,839 200 1,558 34,766 36,524 - 39,363 873 19,978 20,851 25,695 245 8,190 34,130 94,344 6,680 13,673 512 20,865 9,616 37 4,658 278 7,339 3,979 - - 47,572 63,826 94,344 2021 36,042 14,409 21,633 494 21,139 195 260 1,545 2,000 19,139 1,539 20,678 7,296 13,382 19,480 452 (14,163) (1,245) 47,572

(Rs in million) (Rs in million)

100.00% 120.00% 0.00% 72.37% 84.72% 87.51% 0.00% 293.74% 164.40% % 147.05% 104.17% 198.95% 68.47% 228.08% 137.14% 216.44% 246.96% 219.92% 229.96% 323.03% 244.75% 325.52% 226.38% 186.60% 88.11% 150.04% 456.85% 399.93%

% 100.00% 100.00% 137.04% 134.70% 133.54% 103.61% 128.07% 126.84% 421.71% 192.33% 334.66% 164.40% 307.77% 100.00% 225.00% 106.16% 106.12% 228.84% 252.46% 116.67% 340.77%

2020 5,000 2,839 200 1,558 35,670 37,428 - 40,267 861 20,027 20,888 23,409 214 6,818 30,441 91,596 7,542 12,356 2,773 22,671 9,616 27 4,497 399 7,634 3,696 7 6,368 36,681 59,282 91,596 2020 36,540 14,172 22,368 1,405 20,963 192 2,212 1,383 3,787 17,176 4,558 21,734 5,358 16,376 23,263 (2,706) (14,170) 900 43,048

(Rs in million) (Rs in million)

100.00% 120.00% 100.00% 100.00% 128.61% 126.80% 0.00% 126.26% 101.68% 109.08% 108.71% 348.21% 169.14% 280.52% 146.26% 81.56% 75.79% 5.88% 75.68% 100.00% 216.67% 92.49% 78.99% 267.03% 173.84% 0.00% 146.26% % 175.74% 134.20% 226.01% 99.85% 254.17% 129.29% 369.28% 308.57% 330.02% 236.68% 508.65% 279.90% 484.99% 233.23% 171.85% -4.46% 122.51% 332.23%

% 13550.00% 332.23% 258.85% 2150.25%

2019 5,000 2,839 200 1,558 33,475 35,233 - 38,072 845 17,057 17,902 19,329 191 5,996 25,516 81,490 8,499 11,054 53 19,606 9,616 26 3,918 297 8,908 2,545 813 - 35,761 52,242 81,490 2019 43,668 18,258 25,410 2,049 23,361 181 3,774 1,728 5,683 17,678 7,177 24,855 7,983 16,872 21,425 137 (11,570) 4,236 35,761

(Rs in million) (Rs in million)

100.00% 100.00% 100.00% 100.00% 110.05% 109.41% 100.00% 108.68% 100.72% 100.04% 100.08% 90.25% 86.37% 94.93% 84.32% 77.93% 0.00% 125.93% % 131.46% 114.14% 152.41% 145.71% 153.91% 121.43% 187.77% 172.68% 177.47% 148.48% 231.18% 161.63% 180.38% 157.37% 155.03% 109.44% 106.12% 714.21% 200.05%

% 287.64% 134.81% 229.96% 125.93% 287.57% 100.00% 125.00% 247.06% 156.83% 100.00% 200.05% 178.09%

2018 5,000 2,365 200 1,558 28,643 30,401 2 32,769 837 15,643 16,481 15,967 171 4,779 20,917 70,167 9,405 12,597 2,591 24,593 9,616 15 3,572 293 8,242 2,296 6 - 21,533 35,943 70,167 2018 32,665 15,529 17,136 2,990 14,146 170 1,919 967 3,056 11,090 3,262 14,353 2,969 11,384 19,327 (3,361) (10,022) 1,407 21,533

(Rs in million) (Rs in million)

% 100.00% 100.00% 100.00% 100.00% 105.17% 104.84% 100.00% 104.46% 101.93% 95.92% 96.22% 106.34% 124.23% 113.31% 103.47% 94.57% 91.69% 209.10% 96.93% 100.00% 141.67% 92.00% 59.04% 98.71% 89.21% 100.00% 0.00% 131.75% 113.50% 103.47% % 109.79% 97.09% 125.16% 71.54% 137.13% 77.86% 72.99% 144.46% 96.63% 146.47% 104.39% 139.79% 166.10% 133.80% 125.72% 127.52% 87.62% -32.99% 131.75%

2017 5,000 2,365 200 1,558 27,373 29,131 2 31,498 847 14,999 15,846 5,903 4,404 10,307 57,651 9,855 13,373 1,884 25,112 9,616 17 3,897 222 3,293 1,306 6 - 14,182 22,906 57,651 2017 27,281 13,209 14,072 1,468 12,604 109 746 809 1,664 10,940 1,473 12,413 2,734 9,679 15,674 (3,916) (8,275) (65) 14,182

(Rs in million) (Rs in million)

100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 0.00% 100.00% % 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00%

% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00%

2016 5,000 2,365 200 1,558 26,028 27,786 2 30,153 831 15,637 16,468 5,551 3,545 9,096 55,717 10,421 14,585 901 25,907 9,616 12 4,236 376 3,336 1,464 6 - 10,764 20,182 55,717 2016 24,848 13,605 11,243 2,052 9,191 140 1,022 560 1,722 7,469 1,411 8,880 1,646 7,234 12,467 (3,071) (9,444) 197 10,764

(Rs in million) (Rs in million)

BALANCE SHEET SHARE CAPITAL AND RESERVES Authorised capital Issued, subscribed and paid-up capital Revenue reserves Insurance reserve Investment reserve Unappropriated profit Fair value gain on available-for-sale investments NON CURRENT LIABILITIES Long term deposits Deferred liabilities CURRENT LIABILITIES AND PROVISIONS Trade and other payables Unclaimed dividend Provision for income tax CONTINGENCIES AND COMMITMENTS TOTAL EQUITY AND LIABILITIES FIXED

ANNUAL REPORT 2021 97