Page 102 - Pakistan Oilfields Limited - Annual Report 2021

P. 102

ANNUAL FINANCIAL REVIEW

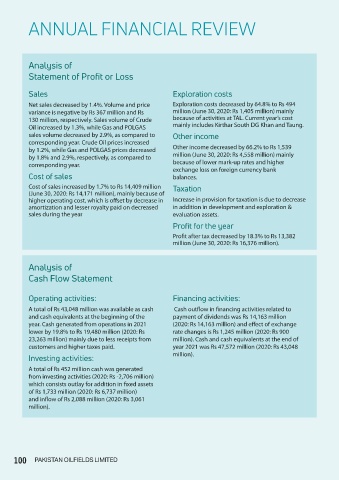

Analysis of

Statement of Profit or Loss

Sales Exploration costs

Net sales decreased by 1.4%. Volume and price Exploration costs decreased by 64.8% to Rs 494

variance is negative by Rs 367 million and Rs million (June 30, 2020: Rs 1,405 million) mainly

130 million, respectively. Sales volume of Crude because of activities at TAL. Current year’s cost

Oil increased by 1.3%, while Gas and POLGAS mainly includes Kirthar South DG Khan and Taung.

sales volume decreased by 2.9%, as compared to Other income

corresponding year. Crude Oil prices increased

by 1.2%, while Gas and POLGAS prices decreased Other income decreased by 66.2% to Rs 1,539

by 1.8% and 2.9%, respectively, as compared to million (June 30, 2020: Rs 4,558 million) mainly

corresponding year. because of lower mark-up rates and higher

exchange loss on foreign currency bank

Cost of sales balances.

Cost of sales increased by 1.7% to Rs 14,409 million Taxation

(June 30, 2020: Rs 14,171 million), mainly because of

higher operating cost, which is offset by decrease in Increase in provision for taxation is due to decrease

amortization and lesser royalty paid on decreased in addition in development and exploration &

sales during the year evaluation assets.

Profit for the year

Profit after tax decreased by 18.3% to Rs 13,382

million (June 30, 2020: Rs 16,376 million).

Analysis of

Cash Flow Statement

Operating activities: Financing activities:

A total of Rs 43,048 million was available as cash Cash outflow in financing activities related to

and cash equivalents at the beginning of the payment of dividends was Rs 14,163 million

year. Cash generated from operations in 2021 (2020: Rs 14,163 million) and effect of exchange

lower by 19.8% to Rs 19,480 million (2020: Rs rate changes is Rs 1,245 million (2020: Rs 900

23,263 million) mainly due to less receipts from million). Cash and cash equivalents at the end of

customers and higher taxes paid. year 2021 was Rs 47,572 million (2020: Rs 43,048

Investing activities: million).

A total of Rs 452 million cash was generated

from investing activities (2020: Rs -2,706 million)

which consists outlay for addition in fixed assets

of Rs 1,733 million (2020: Rs 6,737 million)

and inflow of Rs 2,088 million (2020: Rs 3,061

million).

100 PAKISTAN OILFIELDS LIMITED