Page 152 - Pakistan Oilfields Limited - Annual Report 2021

P. 152

NOTES TO AND FORMING

PART OF THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2021

2021 2020

Note Rupees ('000)

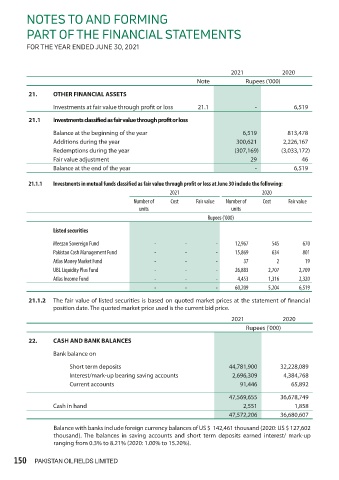

21. OTHER FINANCIAL ASSETS

Investments at fair value through profit or loss 21.1 - 6,519

21.1 Investments classified as fair value through profit or loss

Balance at the beginning of the year 6,519 813,478

Additions during the year 300,621 2,226,167

Redemptions during the year (307,169) (3,033,172)

Fair value adjustment 29 46

Balance at the end of the year - 6,519

21.1.1 Investments in mutual funds classified as fair value through profit or loss at June 30 include the following:

2021 2020

Number of Cost Fair value Number of Cost Fair value

units units

Rupees ('000)

Listed securities

Meezan Sovereign Fund - - - 12,967 545 670

Pakistan Cash Management Fund - - - 15,869 634 801

Atlas Money Market Fund - - - 37 2 19

UBL Liquidity Plus Fund - - - 26,883 2,707 2,709

Atlas Income Fund - - - 4,453 1,316 2,320

- - - 60,209 5,204 6,519

21.1.2 The fair value of listed securities is based on quoted market prices at the statement of financial

position date. The quoted market price used is the current bid price.

2021 2020

Rupees ('000)

22. CASH AND BANK BALANCES

Bank balance on

Short term deposits 44,781,900 32,228,089

Interest/mark-up bearing saving accounts 2,696,309 4,384,768

Current accounts 91,446 65,892

47,569,655 36,678,749

Cash in hand 2,551 1,858

47,572,206 36,680,607

Balance with banks include foreign currency balances of US $ 142,461 thousand (2020: US $ 127,602

thousand). The balances in saving accounts and short term deposits earned interest/ mark-up

ranging from 0.3% to 8.21% (2020: 1.00% to 15.20%).

150 PAKISTAN OILFIELDS LIMITED