Page 154 - Pakistan Oilfields Limited - Annual Report 2021

P. 154

NOTES TO AND FORMING

PART OF THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2021

rights already accrued in favour of the Company. The Government has no authority to give any law or

policy a retrospective effect. The Company filed Constitutional Petition challenging the imposition

of WLO on February 19, 2018 against Federation of Pakistan through Ministry of Energy (Petroleum

Division), Islamabad. The Honorable Islamabad High Court after hearing the petitioner on February

20, 2018, directed the parties to maintain the status quo in this respect. The case came up for

hearing on June 12, 2019 but was adjourned on the request of legal counsel of the Government.

The Islamabad High Court had fixed March 19, 2020 as next date of hearing, but the hearing was

cancelled due to preventive measures taken in the courts amid Coronavirus. The case again came

up for hearing on March 17, 2021 before the Honourable Chief Justice of Islamabad High Court,

who passed the order for appearance of Secretary Petroleum (Gas Division) on April 20, 2021. The

Islamabad High Court did not fix the case on April 20, 2021 due to Covid-19 SOP being observed in

Islamabad High Court, Islamabad. The next date of hearing has not yet been fixed by the court.

On prudent basis additional revenue (net of sales tax) on account of enhanced gas price incentive

due to conversion from Petroleum Policy 1997 to Petroleum Policy 2012 since inception to June 30,

2021 amounting to Rs 16,196,113 thousand will be accounted for upon resolution of this matter

(including Rs 13,949,495 thousand related to period since inception to June 30, 2020). Additional

revenue on account of enhanced gas price incentive of Rs 18,949,452 thousand including sales tax

of Rs 2,753,339 thousand received from customer on the basis of notified prices has been shown

as “Other liabilities” under “trade and other payables”. Sales tax of Rs 2,753,339 thousand received

from customer on the basis of notified prices is declared in the monthly sales tax return as well as

duly deposited with Federal Board of Revenue by the Company. The amount so deposited is shown

within “sales tax refundable” in “advances, deposits, prepayments and other receivables”.

2021 2020

Rupees ('000)

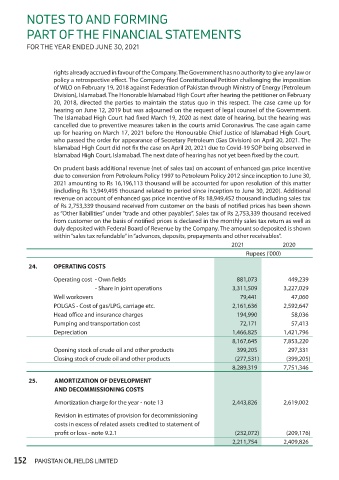

24. OPERATING COSTS

Operating cost - Own fields 881,073 449,239

- Share in joint operations 3,311,509 3,227,029

Well workovers 79,441 47,060

POLGAS - Cost of gas/LPG, carriage etc. 2,161,636 2,592,647

Head office and insurance charges 194,990 58,036

Pumping and transportation cost 72,171 57,413

Depreciation 1,466,825 1,421,796

8,167,645 7,853,220

Opening stock of crude oil and other products 399,205 297,331

Closing stock of crude oil and other products (277,531) (399,205)

8,289,319 7,751,346

25. AMORTIZATION OF DEVELOPMENT

AND DECOMMISSIONING COSTS

Amortization charge for the year - note 13 2,443,826 2,619,002

Revision in estimates of provision for decommissioning

costs in excess of related assets credited to statement of

profit or loss - note 9.2.1 (232,072) (209,176)

2,211,754 2,409,826

152 PAKISTAN OILFIELDS LIMITED