Page 157 - Pakistan Oilfields Limited - Annual Report 2021

P. 157

NOTES TO AND FORMING

PART OF THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2021

2021 2020

Rupees ('000)

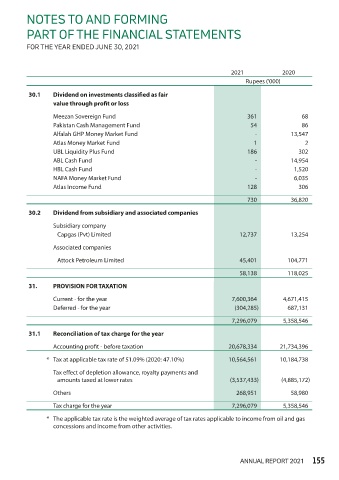

30.1 Dividend on investments classified as fair

value through profit or loss

Meezan Sovereign Fund 361 68

Pakistan Cash Management Fund 54 86

Alfalah GHP Money Market Fund - 13,547

Atlas Money Market Fund 1 2

UBL Liquidity Plus Fund 186 302

ABL Cash Fund - 14,954

HBL Cash Fund - 1,520

NAFA Money Market Fund - 6,035

Atlas Income Fund 128 306

730 36,820

30.2 Dividend from subsidiary and associated companies

Subsidiary company

Capgas (Pvt) Limited 12,737 13,254

Associated companies

Attock Petroleum Limited 45,401 104,771

58,138 118,025

31. PROVISION FOR TAXATION

Current - for the year 7,600,364 4,671,415

Deferred - for the year (304,285) 687,131

7,296,079 5,358,546

31.1 Reconciliation of tax charge for the year

Accounting profit - before taxation 20,678,334 21,734,396

* Tax at applicable tax rate of 51.09% (2020: 47.10%) 10,564,561 10,184,738

Tax effect of depletion allowance, royalty payments and

amounts taxed at lower rates (3,537,433) (4,885,172)

Others 268,951 58,980

Tax charge for the year 7,296,079 5,358,546

* The applicable tax rate is the weighted average of tax rates applicable to income from oil and gas

concessions and income from other activities.

ANNUAL REPORT 2021 155