Page 191 - Pakistan Oilfields Limited - Annual Report 2021

P. 191

NOTES TO AND FORMING

PART OF THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2021

1. LEGAL STATUS AND OPERATIONS Effective date

(annual reporting

Pakistan Oilfields Limited (the Company) is incorporated in Pakistan as a public limited company periods beginning

and its shares are quoted on Pakistan Stock Exchange Limited. The registered office of the Company on or after)

is situated at Morgah, Rawalpindi. The Company is principally engaged in exploration, drilling

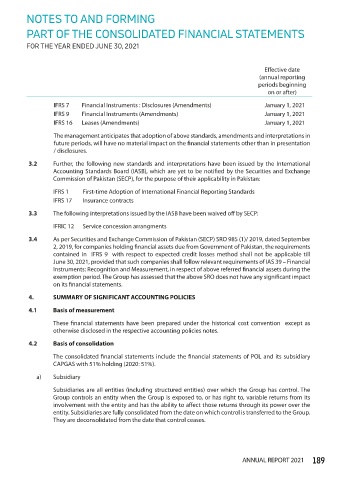

and production of crude oil and gas in Pakistan. Its activities also include marketing of liquefied IFRS 7 Financial Instruments : Disclosures (Amendments) January 1, 2021

petroleum gas under the brand name POLGAS and transmission of petroleum. The Company is a IFRS 9 Financial Instruments (Amendments) January 1, 2021

subsidiary of The Attock Oil Company Limited, UK and its ultimate parent is Coral Holding Limited. IFRS 16 Leases (Amendments) January 1, 2021

CAPGAS (Private) Limited (CAPGAS), the subsidiary company is incorporated in Pakistan as a private The management anticipates that adoption of above standards, amendments and interpretations in

limited company under the Companies Act, 2017 and is principally engaged in buying, filling, future periods, will have no material impact on the financial statements other than in presentation

distribution and dealing in Liquefied Petroleum Gas (LPG). / disclosures.

For the purpose of these financial statements, POL and its consolidated subsidiary are referred as 3.2 Further, the following new standards and interpretations have been issued by the International

the Group. Accounting Standards Board (IASB), which are yet to be notified by the Securities and Exchange

Commission of Pakistan (SECP), for the purpose of their applicability in Pakistan:

Geographical location and addresses of all other business units of the Group have been disclosed

in note 47. IFRS 1 First-time Adoption of International Financial Reporting Standards

IFRS 17 Insurance contracts

2. STATEMENT OF COMPLIANCE

3.3 The following interpretations issued by the IASB have been waived off by SECP:

These are consolidated financial statements of the Group. These financial statements have been

prepared in accordance with the accounting and reporting standards as applicable in Pakistan. The IFRIC 12 Service concession arrangments

accounting and reporting standards applicable in Pakistan comprise of:

3.4 As per Securities and Exchange Commission of Pakistan (SECP) SRO 985 (1)/ 2019, dated September

- International Financial Reporting Standards (IFRS Standards) issued by the International 2, 2019, for companies holding financial assets due from Government of Pakistan, the requirements

Accounting Standards Board (IASB) as notified under the Companies Act, 2017; and contained in IFRS 9 with respect to expected credit losses method shall not be applicable till

- Provisions of and directives issued under the Companies Act, 2017. June 30, 2021, provided that such companies shall follow relevant requirements of IAS 39 – Financial

Instruments: Recognition and Measurement, in respect of above referred financial assets during the

Where provisions of and directives issued under the Companies Act, 2017 differ from the IFRS exemption period. The Group has assessed that the above SRO does not have any significant impact

Standards, the provisions of and directives issued under the Companies Act, 2017 have been on its financial statements.

followed.

4. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

3. NEW AND AMENDED STANDARDS AND INTERPRETATIONS

4.1 Basis of measurement

3.1 Standards, amendments and interpretations to existing standards that are not yet effective and

have not been early adopted by the Group: These financial statements have been prepared under the historical cost convention except as

otherwise disclosed in the respective accounting policies notes.

Effective date

(annual reporting 4.2 Basis of consolidation

periods beginning

on or after) The consolidated financial statements include the financial statements of POL and its subsidiary

CAPGAS with 51% holding (2020: 51%).

IAS 1 Presentation of financial statements (Amendments) January 1, 2023

IAS 8 Accounting policies, changes in accounting estimates a) Subsidiary

and errors (Amendments) January 1, 2023 Subsidiaries are all entities (including structured entities) over which the Group has control. The

IAS 12 Income Taxes (Amendments) January 1, 2023 Group controls an entity when the Group is exposed to, or has right to, variable returns from its

IAS 16 Property, Plant and Equipment (Amendments) January 1, 2023 involvement with the entity and has the ability to affect those returns through its power over the

IAS 37 Provisions, Contingent Liabilities and Contingent Assets entity. Subsidiaries are fully consolidated from the date on which control is transferred to the Group.

They are deconsolidated from the date that control ceases.

(Amendments) January 1, 2022

IFRS 3 Business Combinations (Amendments) January 1, 2022

ANNUAL REPORT 2021 189