Page 224 - Pakistan Oilfields Limited - Annual Report 2021

P. 224

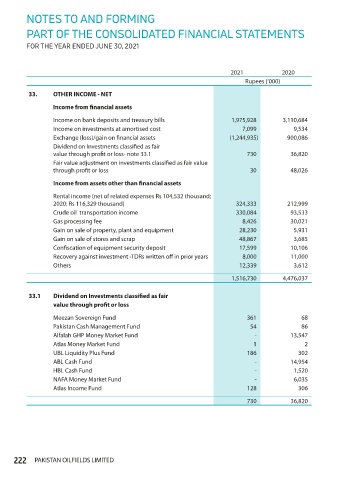

NOTES TO AND FORMING

PART OF THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2021

2021 2020

Rupees (‘000)

33. OTHER INCOME - NET

Income from financial assets

Income on bank deposits and treasury bills 1,975,928 3,110,684

Income on investments at amortised cost 7,099 9,534

Exchange (loss)/gain on financial assets (1,244,935) 900,086

Dividend on Investments classified as fair

value through profit or loss- note 33.1 730 36,820

Fair value adjustment on investments classified as fair value

through profit or loss 30 48,026

Income from assets other than financial assets

Rental income (net of related expenses Rs 104,532 thousand;

2020: Rs 116,329 thousand) 324,333 212,999

Crude oil transportation income 330,084 93,533

Gas processing fee 8,426 30,021

Gain on sale of property, plant and equipment 28,230 5,931

Gain on sale of stores and scrap 48,867 3,685

Confiscation of equipment security deposit 17,599 10,106

Recovery against investment -TDRs written off in prior years 8,000 11,000

Others 12,339 3,612

1,516,730 4,476,037

33.1 Dividend on Investments classified as fair

value through profit or loss

Meezan Sovereign Fund 361 68

Pakistan Cash Management Fund 54 86

Alfalah GHP Money Market Fund - 13,547

Atlas Money Market Fund 1 2

UBL Liquidity Plus Fund 186 302

ABL Cash Fund - 14,954

HBL Cash Fund - 1,520

NAFA Money Market Fund - 6,035

Atlas Income Fund 128 306

730 36,820

222 PAKISTAN OILFIELDS LIMITED