Page 225 - Pakistan Oilfields Limited - Annual Report 2021

P. 225

NOTES TO AND FORMING

PART OF THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2021

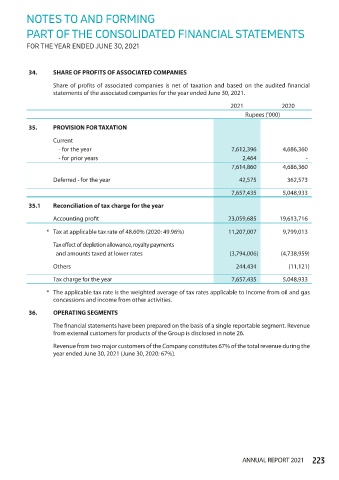

34. SHARE OF PROFITS OF ASSOCIATED COMPANIES

Share of profits of associated companies is net of taxation and based on the audited financial

statements of the associated companies for the year ended June 30, 2021.

2021 2020

Rupees ('000)

35. PROVISION FOR TAXATION

Current

- for the year 7,612,396 4,686,360

- for prior years 2,464 -

7,614,860 4,686,360

Deferred - for the year 42,575 362,573

7,657,435 5,048,933

35.1 Reconciliation of tax charge for the year

Accounting profit 23,059,685 19,613,716

* Tax at applicable tax rate of 48.60% (2020: 49.96%) 11,207,007 9,799,013

Tax effect of depletion allowance, royalty payments

and amounts taxed at lower rates (3,794,006) (4,738,959)

Others 244,434 (11,121)

Tax charge for the year 7,657,435 5,048,933

* The applicable tax rate is the weighted average of tax rates applicable to income from oil and gas

concessions and income from other activities.

36. OPERATING SEGMENTS

The financial statements have been prepared on the basis of a single reportable segment. Revenue

from external customers for products of the Group is disclosed in note 26.

Revenue from two major customers of the Company constitutes 67% of the total revenue during the

year ended June 30, 2021 (June 30, 2020: 67%).

ANNUAL REPORT 2021 223