Page 220 - Pakistan Oilfields Limited - Annual Report 2021

P. 220

NOTES TO AND FORMING

PART OF THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2021

2021 2020

Rupees ('000)

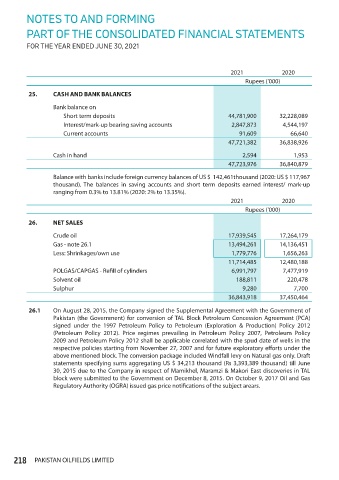

25. CASH AND BANK BALANCES

Bank balance on

Short term deposits 44,781,900 32,228,089

Interest/mark-up bearing saving accounts 2,847,873 4,544,197

Current accounts 91,609 66,640

47,721,382 36,838,926

Cash in hand 2,594 1,953

47,723,976 36,840,879

Balance with banks include foreign currency balances of US $ 142,461thousand (2020: US $ 117,967

thousand). The balances in saving accounts and short term deposits earned interest/ mark-up

ranging from 0.3% to 13.81% (2020: 2% to 13.35%).

2021 2020

Rupees ('000)

26. NET SALES

Crude oil 17,939,545 17,264,179

Gas - note 26.1 13,494,261 14,136,451

Less: Shrinkages/own use 1,779,776 1,656,263

11,714,485 12,480,188

POLGAS/CAPGAS - Refill of cylinders 6,991,797 7,477,919

Solvent oil 188,811 220,478

Sulphur 9,280 7,700

36,843,918 37,450,464

26.1 On August 28, 2015, the Company signed the Supplemental Agreement with the Government of

Pakistan (the Government) for conversion of TAL Block Petroleum Concession Agreement (PCA)

signed under the 1997 Petroleum Policy to Petroleum (Exploration & Production) Policy 2012

(Petroleum Policy 2012). Price regimes prevailing in Petroleum Policy 2007, Petroleum Policy

2009 and Petroleum Policy 2012 shall be applicable correlated with the spud date of wells in the

respective policies starting from November 27, 2007 and for future exploratory efforts under the

above mentioned block. The conversion package included Windfall levy on Natural gas only. Draft

statements specifying sums aggregating US $ 34,213 thousand (Rs 3,393,389 thousand) till June

30, 2015 due to the Company in respect of Mamikhel, Maramzi & Makori East discoveries in TAL

block were submitted to the Government on December 8, 2015. On October 9, 2017 Oil and Gas

Regulatory Authority (OGRA) issued gas price notifications of the subject arears.

218 PAKISTAN OILFIELDS LIMITED