Page 242 - Pakistan Oilfields Limited - Annual Report 2021

P. 242

NOTES TO AND FORMING

PART OF THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2021

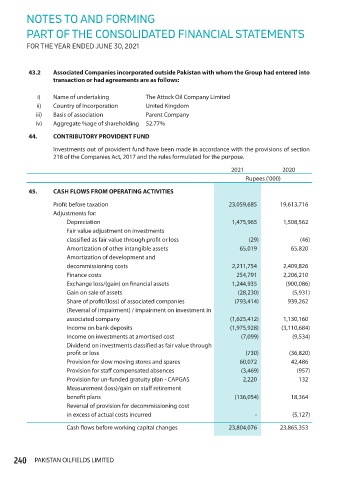

43.2 Associated Companies incorporated outside Pakistan with whom the Group had entered into

transaction or had agreements are as follows:

i) Name of undertaking The Attock Oil Company Limited

ii) Country of Incorporation United Kingdom

iii) Basis of association Parent Company

iv) Aggregate %age of shareholding 52.77%

44. CONTRIBUTORY PROVIDENT FUND

Investments out of provident fund have been made in accordance with the provisions of section

218 of the Companies Act, 2017 and the rules formulated for the purpose.

2021 2020

Rupees (‘000)

45. CASH FLOWS FROM OPERATING ACTIVITIES

Profit before taxation 23,059,685 19,613,716

Adjustments for:

Depreciation 1,475,965 1,508,562

Fair value adjustment on investments

classified as fair value through profit or loss (29) (46)

Amortization of other intangible assets 65,019 65,820

Amortization of development and

decommissioning costs 2,211,754 2,409,826

Finance costs 254,791 2,206,210

Exchange loss/(gain) on financial assets 1,244,935 (900,086)

Gain on sale of assets (28,230) (5,931)

Share of profit/(loss) of associated companies (793,414) 939,262

(Reversal of impairment) / impairment on investment in

associated company (1,625,412) 1,130,160

Income on bank deposits (1,975,928) (3,110,684)

Income on investments at amortised cost (7,099) (9,534)

Dividend on investments classified as fair value through

profit or loss (730) (36,820)

Provision for slow moving stores and spares 60,072 42,486

Provision for staff compensated absences (3,469) (957)

Provision for un-funded gratuity plan - CAPGAS 2,220 132

Measurement (loss)/gain on staff retirement

benefit plans (136,054) 18,364

Reversal of provision for decommissioning cost

in excess of actual costs incurred - (5,127)

Cash flows before working capital changes 23,804,076 23,865,353

240 PAKISTAN OILFIELDS LIMITED