Page 243 - Pakistan Oilfields Limited - Annual Report 2021

P. 243

NOTES TO AND FORMING

PART OF THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2021

2021 2020

Rupees (‘000)

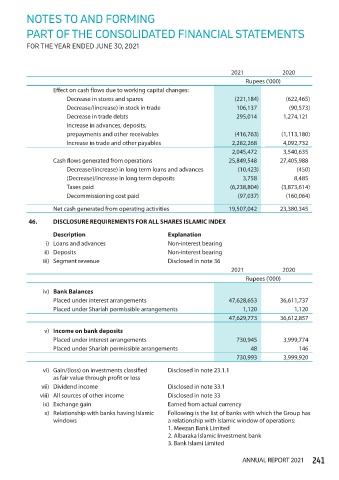

Effect on cash flows due to working capital changes:

Decrease in stores and spares (221,184) (622,465)

Decrease/(increase) in stock in trade 106,137 (90,573)

Decrease in trade debts 295,014 1,274,121

Increase in advances, deposits,

prepayments and other receivables (416,763) (1,113,180)

Increase in trade and other payables 2,282,268 4,092,732

2,045,472 3,540,635

Cash flows generated from operations 25,849,548 27,405,988

Decrease/(increase) in long term loans and advances (10,423) (450)

(Decrease)/increase in long term deposits 3,758 8,485

Taxes paid (6,238,804) (3,873,614)

Decommissioning cost paid (97,037) (160,064)

Net cash generated from operating activities 19,507,042 23,380,345

46. DISCLOSURE REQUIREMENTS FOR ALL SHARES ISLAMIC INDEX

Description Explanation

i) Loans and advances Non-interest bearing

ii) Deposits Non-interest bearing

iii) Segment revenue Disclosed in note 36

2021 2020

Rupees ('000)

iv) Bank Balances

Placed under interest arrangements 47,628,653 36,611,737

Placed under Shariah permissible arrangements 1,120 1,120

47,629,773 36,612,857

v) Income on bank deposits

Placed under interest arrangements 730,945 3,999,774

Placed under Shariah permissible arrangements 48 146

730,993 3,999,920

vi) Gain/(loss) on investments classified Disclosed in note 23.1.1

as fair value through profit or loss

vii) Dividend income Disclosed in note 33.1

viii) All sources of other income Disclosed in note 33

ix) Exchange gain Earned from actual currency

x) Relationship with banks having Islamic Following is the list of banks with which the Group has

windows a relationship with Islamic window of operations:

1. Meezan Bank Limited

2. Albaraka Islamic Investment bank

3. Bank Islami Limited

ANNUAL REPORT 2021 241