Page 238 - Pakistan Oilfields Limited - Annual Report 2021

P. 238

NOTES TO AND FORMING

PART OF THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2021

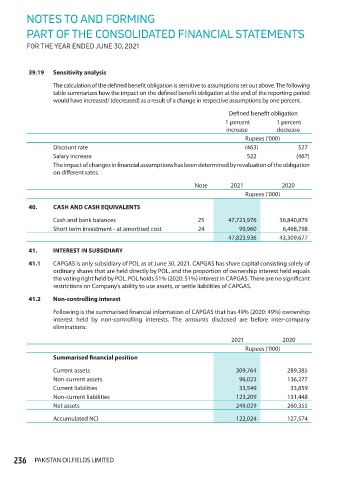

39.19 Sensitivity analysis

The calculation of the defined benefit obligation is sensitive to assumptions set out above. The following

table summarizes how the impact on the defined benefit obligation at the end of the reporting period

would have increased/ (decreased) as a result of a change in respective assumptions by one percent.

Defined benefit obligation

1 percent 1 percent

increase decrease

Rupees ('000)

Discount rate (463) 527

Salary increase 522 (467)

The impact of changes in financial assumptions has been determined by revaluation of the obligation

on different rates.

Note 2021 2020

Rupees ('000)

40. CASH AND CASH EQUIVALENTS

Cash and bank balances 25 47,723,976 36,840,879

Short term investment - at amortised cost 24 99,960 6,468,798

47,823,936 43,309,677

41. INTEREST IN SUBSIDIARY

41.1 CAPGAS is only subsidiary of POL as at June 30, 2021. CAPGAS has share capital consisting solely of

ordinary shares that are held directly by POL, and the proportion of ownership interest held equals

the voting right held by POL. POL holds 51% (2020: 51%) interest in CAPGAS. There are no significant

restrictions on Company’s ability to use assets, or settle liabilities of CAPGAS.

41.2 Non-controlling interest

Following is the summarised financial information of CAPGAS that has 49% (2020: 49%) ownership

interest held by non-controlling interests. The amounts disclosed are before inter-company

eliminations:

2021 2020

Rupees ('000)

Summarised financial position

Current assets 309,764 289,385

Non-current assets 96,023 136,277

Current liabilities 33,549 33,859

Non-current liabilities 123,209 131,448

Net assets 249,029 260,355

Accumulated NCI 122,024 127,574

236 PAKISTAN OILFIELDS LIMITED