Page 49 - Pakistan Oilfields Limited - Annual Report 2021

P. 49

DIRECTORS’ REPORT

The decrease in profit mainly related to national exchequer, in the shape of royalty and

notional exchange loss on foreign currency other government levies, was Rs 16,864 million

bank balances/deposits, lesser income on (2020: Rs 14,142 million).

bank deposits because of overall reduced

deposits rates and higher taxation due to lesser DIVIDEND

exploration and development cost. During the The Directors have recommended a final cash

year, production of crude oil and gas were lower dividend @ 300% (Rs 30 per share). This is in

by 0.77% and 2.5%, respectively, in comparison addition to the interim cash dividend @ 200%

to last year. While production of LPG was higher (Rs 20.00 per share) already declared and paid

by 1.58% in comparison to last year. to the shareholders thereby making it to total

cash dividend of Rs 50 per share for the year

During the year, the Company has made

consolidated profit after tax of Rs 15,402 2020-21 (2019-20: Total cash dividend of Rs

million (June 30, 2020: Rs. 14,565 million) which 50.00 per share).

translates into consolidated earnings per share PRODUCTION

of Rs 54.24 (June 30, 2020: Rs. 51.23).

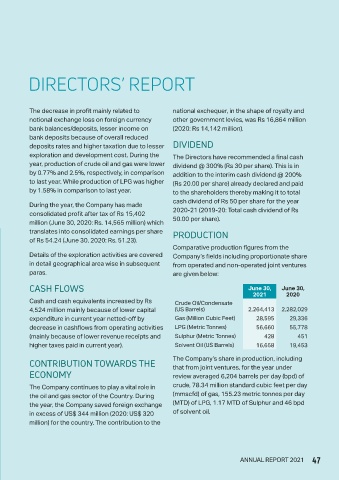

Comparative production figures from the

Details of the exploration activities are covered Company’s fields including proportionate share

in detail geographical area wise in subsequent from operated and non-operated joint ventures

paras. are given below:

CASH FLOWS June 30, June 30,

2021 2020

Cash and cash equivalents increased by Rs Crude Oil/Condensate

4,524 million mainly because of lower capital (US Barrels) 2,264,413 2,282,029

expenditure in current year netted-off by Gas (Million Cubic Feet) 28,595 29,336

decrease in cashflows from operating activities LPG (Metric Tonnes) 56,660 55,778

(mainly because of lower revenue receipts and Sulphur (Metric Tonnes) 428 451

higher taxes paid in current year). Solvent Oil (US Barrels) 16,658 19,453

CONTRIBUTION TOWARDS THE The Company’s share in production, including

that from joint ventures, for the year under

ECONOMY review averaged 6,204 barrels per day (bpd) of

The Company continues to play a vital role in crude, 78.34 million standard cubic feet per day

the oil and gas sector of the Country. During (mmscfd) of gas, 155.23 metric tonnes per day

the year, the Company saved foreign exchange (MTD) of LPG, 1.17 MTD of Sulphur and 46 bpd

in excess of US$ 344 million (2020: US$ 320 of solvent oil.

million) for the country. The contribution to the

ANNUAL REPORT 2021 47