Page 97 - Pakistan Oilfields Limited - Annual Report 2021

P. 97

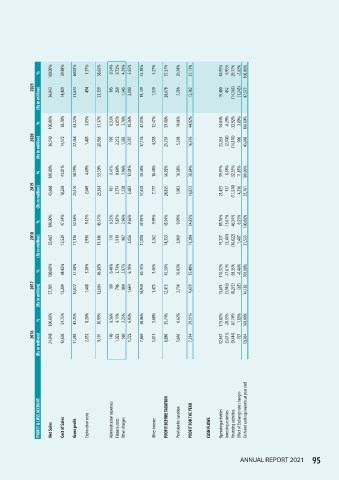

100.00% 39.98% 60.02% 1.37% 58.65% 0.54% 0.72% 4.29% 5.55% 53.10% 4.27% 57.37% 20.24% 37.13% 40.95% 0.95% -29.77% -2.62% 100.00%

%

2021 36,042 14,409 21,633 494 21,139 195 260 1,545 2,000 19,139 1,539 20,678 7,296 13,382 19,480 452 (14,163) (1,245) 47,572

(Rs in million)

100.00% 38.78% 61.22% 3.85% 57.37% 0.53% 6.05% 3.78% 10.36% 47.01% 12.47% 59.48% 14.66% 44.82% 54.04% -6.29% -32.92% 2.09%

% 100.00%

2020 36,540 14,172 22,368 1,405 20,963 192 2,212 1,383 3,787 17,176 4,558 21,734 5,358 16,376 23,263 (2,706) (14,170) 900 43,048

(Rs in million)

% 100.00% 41.81% 58.19% 4.69% 53.50% 0.41% 8.64% 3.96% 13.01% 40.48% 16.44% 56.92% 18.28% 38.64% 59.91% 0.38% -32.35% 11.85% 100.00%

2019 43,668 18,258 25,410 2,049 23,361 181 3,774 1,728 5,683 17,678 7,177 24,855 7,983 16,872 21,425 137 (11,570) 4,236 35,761

(Rs in million)

100.00% 47.54% 52.46% 9.15% 43.31% 0.52% 5.87% 2.96% 9.36% 33.95% 9.99% 43.94% 9.09% 34.85% 89.76% -15.61% -46.54% 6.53%

% 100.00%

2018 32,665 15,529 17,136 2,990 14,146 170 1,919 967 3,056 11,090 3,262 14,353 2,969 11,384 19,327 (3,361) (10,022) 1,407 21,533

(Rs in million)

100.00% 48.42% 51.58% 5.38% 46.20% 0.40% 2.73% 2.97% 6.10% 40.10% 5.40% 45.50% 10.02% 35.48% -27.61% -0.46%

% 110.52% -58.35% 100.00%

2017 27,281 13,209 14,072 1,468 12,604 109 746 809 1,664 10,940 1,473 12,413 2,734 9,679 15,674 (3,916) (8,275) (65) 14,182

(Rs in million)

100.00% 54.75% 45.25% 8.26% 36.99% 0.56% 4.11% 2.25% 6.93% 30.06% 5.68% 35.74% 6.62% 29.11% 115.82% -28.53% -87.74% 1.83% 100.00%

%

2016 24,848 13,605 11,243 2,052 9,191 140 1,022 560 1,722 7,469 1,411 8,880 1,646 7,234 12,467 (3,071) (9,444) 197 10,764

(Rs in million)

PROFIT & LOSS ACCOUNT Net Sales Cost of Sales Gross profit Exploration costs Administration expenses Finance costs Other charges Other income PROFIT BEFORE TAXATION Provision for taxation PROFIT FOR THE YEAR CASH FLOWS Operating activities Investing activities Financing activities Effect of Exchange rate changes Cash and cash equivalents at year end

ANNUAL REPORT 2021 95