Page 116 - Pakistan Oilfield Limited - Annual Report 2022

P. 116

114

PAKISTAN OILFIELDS LIMITED

Analysis of Performance

Indicators

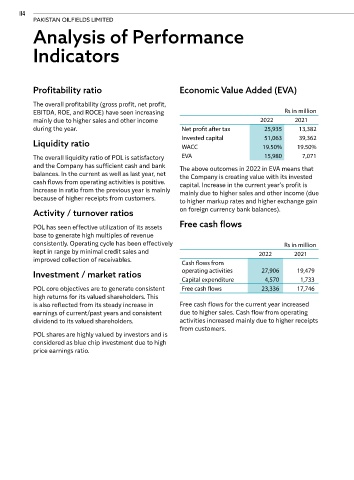

Profitability ratio Economic Value Added (EVA)

The overall profitability (gross profit, net profit,

EBITDA, ROE, and ROCE) have seen increasing Rs in million

mainly due to higher sales and other income 2022 2021

during the year. Net profit after tax 25,935 13,382

Invested capital 51,063 39,362

Liquidity ratio WACC 19.50% 19.50%

The overall liquidity ratio of POL is satisfactory EVA 15,980 7,071

and the Company has sufficient cash and bank The above outcomes in 2022 in EVA means that

balances. In the current as well as last year, net the Company is creating value with its invested

cash flows from operating activities is positive. capital. Increase in the current year’s profit is

Increase in ratio from the previous year is mainly mainly due to higher sales and other income (due

because of higher receipts from customers. to higher markup rates and higher exchange gain

Activity / turnover ratios on foreign currency bank balances).

POL has seen effective utilization of its assets Free cash flows

base to generate high multiples of revenue

consistently. Operating cycle has been effectively Rs in million

kept in range by minimal credit sales and 2022 2021

improved collection of receivables. Cash flows from

Investment / market ratios operating activities 27,906 19,479

Capital expenditure 4,570 1,733

POL core objectives are to generate consistent Free cash flows 23,336 17,746

high returns for its valued shareholders. This

is also reflected from its steady increase in Free cash flows for the current year increased

earnings of current/past years and consistent due to higher sales. Cash flow from operating

dividend to its valued shareholders. activities increased mainly due to higher receipts

from customers.

POL shares are highly valued by investors and is

considered as blue chip investment due to high

price earnings ratio.