Page 117 - Pakistan Oilfield Limited - Annual Report 2022

P. 117

115

Annual Report 2022

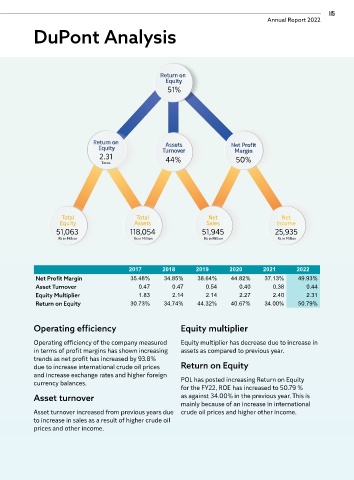

DuPont Analysis

Return on

Equity

51%

Return on Assets Net Pro t

Equity Turnover Margin

2.31 44% 50%

Times

ot

T

Total Total Net N et

et

Net

al

N

e

al

Asse

t

s

Equity Assets s Sales In com e

S

Income

51,063 118,054 51,945 25,935

Rs in Million Rs in Million Rs in Million Rs in Million

2017 2018 2019 2020 2021 2022

Net Profit Margin 35.48% 34.85% 38.64% 44.82% 37.13% 49.93%

Asset Turnover 0.47 0.47 0.54 0.40 0.38 0.44

Equity Multiplier 1.83 2.14 2.14 2.27 2.40 2.31

Return on Equity 30.73% 34.74% 44.32% 40.67% 34.00% 50.79%

Operating efficiency Equity multiplier

Operating efficiency of the company measured Equity multiplier has decrease due to increase in

in terms of profit margins has shown increasing assets as compared to previous year.

trends as net profit has increased by 93.8%

due to increase international crude oil prices Return on Equity

and increase exchange rates and higher foreign

currency balances. POL has posted increasing Return on Equity

for the FY22, ROE has increased to 50.79 %

Asset turnover as against 34.00% in the previous year. This is

mainly because of an increase in international

Asset turnover increased from previous years due crude oil prices and higher other income.

to increase in sales as a result of higher crude oil

prices and other income.