Page 134 - Pakistan Oilfield Limited - Annual Report 2022

P. 134

132 133

PAKISTAN OILFIELDS LIMITED

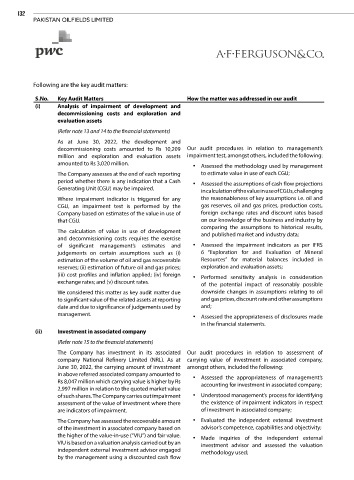

Following are the key audit matters:

S.No. Key Audit Matters How the matter was addressed in our audit

(i) Analysis of impairment of development and

decommissioning costs and exploration and

evaluation assets

(Refer note 13 and 14 to the financial statements)

As at June 30, 2022, the development and

decommissioning costs amounted to Rs 10,209 Our audit procedures in relation to management’s

million and exploration and evaluation assets impairment test, amongst others, included the following:

amounted to Rs 3,020 million. • Assessed the methodology used by management

The Company assesses at the end of each reporting to estimate value in use of each CGU;

period whether there is any indication that a Cash • Assessed the assumptions of cash flow projections

Generating Unit (CGU) may be impaired. in calculation of the value in use of CGUs, challenging

Where impairment indicator is triggered for any the reasonableness of key assumptions i.e. oil and

CGU, an impairment test is performed by the gas reserves, oil and gas prices, production costs,

Company based on estimates of the value in use of foreign exchange rates and discount rates based

that CGU. on our knowledge of the business and industry by

comparing the assumptions to historical results,

The calculation of value in use of development and published market and industry data;

and decommissioning costs requires the exercise

of significant management’s estimates and • Assessed the impairment indicators as per IFRS

judgements on certain assumptions such as (i) 6 “Exploration for and Evaluation of Mineral

estimation of the volume of oil and gas recoverable Resources” for material balances included in

reserves; (ii) estimation of future oil and gas prices; exploration and evaluation assets;

(iii) cost profiles and inflation applied; (iv) foreign • Performed sensitivity analysis in consideration

exchange rates; and (v) discount rates. of the potential impact of reasonably possible

We considered this matter as key audit matter due downside changes in assumptions relating to oil

to significant value of the related assets at reporting and gas prices, discount rate and other assumptions

date and due to significance of judgements used by and;

management. • Assessed the appropriateness of disclosures made

in the financial statements.

(ii) Investment in associated company

(Refer note 15 to the financial statements)

The Company has investment in its associated Our audit procedures in relation to assessment of

company National Refinery Limited (NRL). As at carrying value of investment in associated company,

June 30, 2022, the carrying amount of investment amongst others, included the following:

in above referred associated company amounted to • Assessed the appropriateness of management’s

Rs 8,047 million which carrying value is higher by Rs accounting for investment in associated company;

2,997 million in relation to the quoted market value

of such shares. The Company carries out impairment • Understood management’s process for identifying

assessment of the value of Investment where there the existence of impairment indicators in respect

are indicators of impairment. of investment in associated company;

The Company has assessed the recoverable amount • Evaluated the independent external investment

of the investment in associated company based on advisor’s competence, capabilities and objectivity;

the higher of the value-in-use (“VIU”) and fair value. • Made inquiries of the independent external

VIU is based on a valuation analysis carried out by an investment advisor and assessed the valuation

independent external investment advisor engaged methodology used;

by the management using a discounted cash flow