Page 137 - Pakistan Oilfield Limited - Annual Report 2022

P. 137

134 135

Annual Report 2022

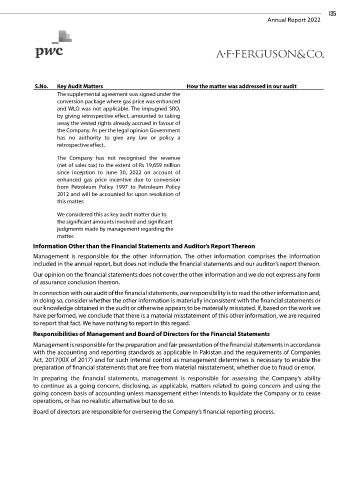

S.No. Key Audit Matters How the matter was addressed in our audit

The supplemental agreement was signed under the

conversion package where gas price was enhanced

and WLO was not applicable. The impugned SRO,

by giving retrospective effect, amounted to taking

away the vested rights already accrued in favour of

the Company. As per the legal opinion Government

has no authority to give any law or policy a

retrospective effect.

The Company has not recognised the revenue

(net of sales tax) to the extent of Rs 19,659 million

since inception to June 30, 2022 on account of

enhanced gas price incentive due to conversion

from Petroleum Policy 1997 to Petroleum Policy

2012 and will be accounted for upon resolution of

this matter.

We considered this as key audit matter due to

the significant amounts involved and significant

judgments made by management regarding the

matter.

Information Other than the Financial Statements and Auditor’s Report Thereon

Management is responsible for the other information. The other information comprises the information

included in the annual report, but does not include the financial statements and our auditor’s report thereon.

Our opinion on the financial statements does not cover the other information and we do not express any form

of assurance conclusion thereon.

In connection with our audit of the financial statements, our responsibility is to read the other information and,

in doing so, consider whether the other information is materially inconsistent with the financial statements or

our knowledge obtained in the audit or otherwise appears to be materially misstated. If, based on the work we

have performed, we conclude that there is a material misstatement of this other information, we are required

to report that fact. We have nothing to report in this regard.

Responsibilities of Management and Board of Directors for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance

with the accounting and reporting standards as applicable in Pakistan and the requirements of Companies

Act, 2017(XIX of 2017) and for such internal control as management determines is necessary to enable the

preparation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, management is responsible for assessing the Company’s ability

to continue as a going concern, disclosing, as applicable, matters related to going concern and using the

going concern basis of accounting unless management either intends to liquidate the Company or to cease

operations, or has no realistic alternative but to do so.

Board of directors are responsible for overseeing the Company’s financial reporting process.