Page 135 - Pakistan Oilfield Limited - Annual Report 2022

P. 135

132 133

Annual Report 2022

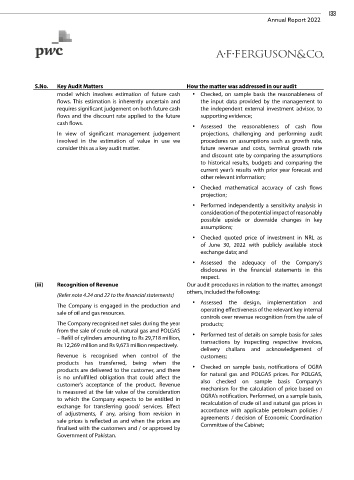

S.No. Key Audit Matters How the matter was addressed in our audit

model which involves estimation of future cash • Checked, on sample basis the reasonableness of

flows. This estimation is inherently uncertain and the input data provided by the management to

requires significant judgement on both future cash the independent external investment advisor, to

flows and the discount rate applied to the future supporting evidence;

cash flows.

• Assessed the reasonableness of cash flow

In view of significant management judgement projections, challenging and performing audit

involved in the estimation of value in use we procedures on assumptions such as growth rate,

consider this as a key audit matter. future revenue and costs, terminal growth rate

and discount rate by comparing the assumptions

to historical results, budgets and comparing the

current year’s results with prior year forecast and

other relevant information;

• Checked mathematical accuracy of cash flows

projection;

• Performed independently a sensitivity analysis in

consideration of the potential impact of reasonably

possible upside or downside changes in key

assumptions;

• Checked quoted price of investment in NRL as

of June 30, 2022 with publicly available stock

exchange data; and

• Assessed the adequacy of the Company’s

disclosures in the financial statements in this

respect.

(iii) Recognition of Revenue Our audit procedures in relation to the matter, amongst

others, included the following:

(Refer note 4.24 and 22 to the financial statements)

• Assessed the design, implementation and

The Company is engaged in the production and operating effectiveness of the relevant key internal

sale of oil and gas resources.

controls over revenue recognition from the sale of

The Company recognised net sales during the year products;

from the sale of crude oil, natural gas and POLGAS

– Refill of cylinders amounting to Rs 29,718 million, • Performed test of details on sample basis for sales

Rs 12,269 million and Rs 9,673 million respectively. transactions by inspecting respective invoices,

delivery challans and acknowledgement of

Revenue is recognised when control of the customers;

products has transferred, being when the

products are delivered to the customer, and there • Checked on sample basis, notifications of OGRA

is no unfulfilled obligation that could affect the for natural gas and POLGAS prices. For POLGAS,

customer’s acceptance of the product. Revenue also checked on sample basis Company’s

is measured at the fair value of the consideration mechanism for the calculation of price based on

to which the Company expects to be entitled in OGRA’s notification. Performed, on a sample basis,

exchange for transferring good/ services. Effect recalculation of crude oil and natural gas prices in

of adjustments, if any, arising from revision in accordance with applicable petroleum policies /

sale prices is reflected as and when the prices are agreements / decision of Economic Coordination

finalised with the customers and / or approved by Committee of the Cabinet;

Government of Pakistan.