Page 158 - Pakistan Oilfield Limited - Annual Report 2022

P. 158

156 157

PAKISTAN OILFIELDS LIMITED

Notes to and Forming Part of the

Financial Statements

For the year ended June 30, 2022

4.29.3 During the year Rs 568,925 thousand (2021: Rs 421,660 thousand) have been capitalised in

Development & Decommissioning costs and Exploration & Evaluation assets in respect of short-

term leases.

5. CRITICAL ACCOUNTING ESTIMATES AND JUDGMENTS

The preparation of financial statements in conformity with approved accounting standards requires

the use of certain accounting estimates. It also requires management to exercise judgment in the

process of applying the Company's accounting policies. Estimates and judgments are continually

evaluated and are based on historical experience, including expectation of future events that are

believed to be reasonable under the circumstances. The areas where various assumptions and

estimates are significant to the Company's financial statements or where judgment was exercised

in application of accounting policies are as follows:

i) Estimated crude oil/gas reserves used for amortization of development and

decommissioning costs - note 4.13 and 13

ii) Estimated useful life of property, plant and equipment - note 4.12 and 12.1

iii) Estimated costs, discount and inflation rate used for provision for decommissioning costs -

note 4.7 and 9.2

iv) Estimate of recoverable amount of investment in associated Company - note 4.14 and 15

v) Estimated value of staff retirement benefits obligations - note 4.9 and 35

vi) Provision for taxation - note 4.5 and 30

vii) Price adjustment related to crude oil sales - note 4.24 and 22

viii) Impairment of financial assets - note 4.21

ix) Right of use asset and corresponding lease liability - note 4.29

2022 2021

Rupees ('000)

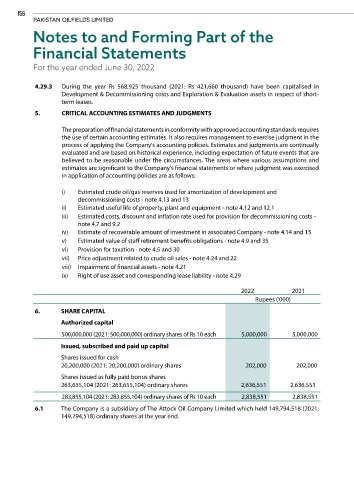

6. SHARE CAPITAL

Authorized capital

500,000,000 (2021: 500,000,000) ordinary shares of Rs 10 each 5,000,000 5,000,000

Issued, subscribed and paid up capital

Shares issued for cash

20,200,000 (2021: 20,200,000) ordinary shares 202,000 202,000

Shares issued as fully paid bonus shares

263,655,104 (2021: 263,655,104) ordinary shares 2,636,551 2,636,551

283,855,104 (2021: 283,855,104) ordinary shares of Rs 10 each 2,838,551 2,838,551

6.1 The Company is a subsidiary of The Attock Oil Company Limited which held 149,794,518 (2021:

149,794,518) ordinary shares at the year end.