Page 159 - Pakistan Oilfield Limited - Annual Report 2022

P. 159

156 157

Annual Report 2022

2022 2021

Rupees ('000)

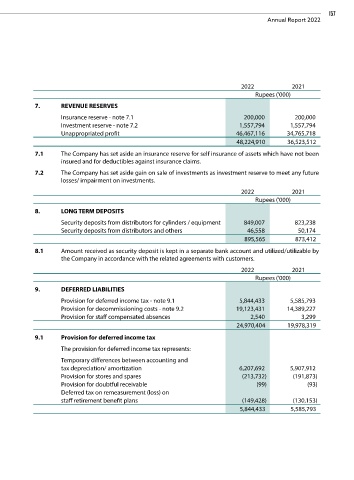

7. REVENUE RESERVES

Insurance reserve - note 7.1 200,000 200,000

Investment reserve - note 7.2 1,557,794 1,557,794

Unappropriated profit 46,467,116 34,765,718

48,224,910 36,523,512

7.1 The Company has set aside an insurance reserve for self insurance of assets which have not been

insured and for deductibles against insurance claims.

7.2 The Company has set aside gain on sale of investments as investment reserve to meet any future

losses/ impairment on investments.

2022 2021

Rupees ('000)

8. LONG TERM DEPOSITS

Security deposits from distributors for cylinders / equipment 849,007 823,238

Security deposits from distributors and others 46,558 50,174

895,565 873,412

8.1 Amount received as security deposit is kept in a separate bank account and utilized/utilizable by

the Company in accordance with the related agreements with customers.

2022 2021

Rupees ('000)

9. DEFERRED LIABILITIES

Provision for deferred income tax - note 9.1 5,844,433 5,585,793

Provision for decommissioning costs - note 9.2 19,123,431 14,389,227

Provision for staff compensated absences 2,540 3,299

24,970,404 19,978,319

9.1 Provision for deferred income tax

The provision for deferred income tax represents:

Temporary differences between accounting and

tax depreciation/ amortization 6,207,692 5,907,912

Provision for stores and spares (213,732) (191,873)

Provision for doubtful receivable (99) (93)

Deferred tax on remeasurement (loss) on

staff retirement benefit plans (149,428) (130,153)

5,844,433 5,585,793