Page 165 - Pakistan Oilfield Limited - Annual Report 2022

P. 165

162 163

Annual Report 2022

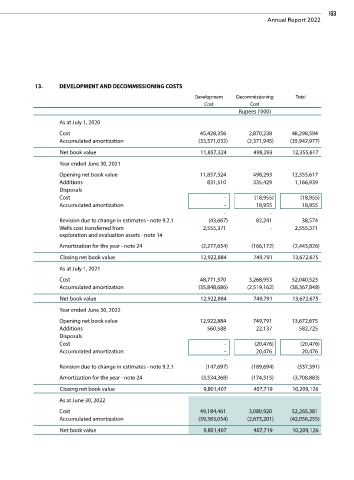

13. DEVELOPMENT AND DECOMMISSIONING COSTS

Development Decommissioning Total

Cost Cost

Rupees ('000)

As at July 1, 2020

Cost 45,428,356 2,870,238 48,298,594

Accumulated amortization (33,571,032) (2,371,945) (35,942,977)

Net book value 11,857,324 498,293 12,355,617

Year ended June 30, 2021

Opening net book value 11,857,324 498,293 12,355,617

Additions 831,510 335,429 1,166,939

Disposals

Cost - (18,955) (18,955)

Accumulated amortization - 18,955 18,955

- - -

Revision due to change in estimates - note 9.2.1 (43,667) 82,241 38,574

Wells cost transferred from 2,555,371 - 2,555,371

exploration and evaluation assets - note 14

Amortization for the year - note 24 (2,277,654) (166,172) (2,443,826)

Closing net book value 12,922,884 749,791 13,672,675

As at July 1, 2021

Cost 48,771,570 3,268,953 52,040,523

Accumulated amortization (35,848,686) (2,519,162) (38,367,848)

Net book value 12,922,884 749,791 13,672,675

Year ended June 30, 2022

Opening net book value 12,922,884 749,791 13,672,675

Additions 560,588 22,137 582,725

Disposals

Cost - (20,476) (20,476)

Accumulated amortization - 20,476 20,476

- - -

Revision due to change in estimates - note 9.2.1 (147,697) (189,694) (337,391)

Amortization for the year - note 24 (3,534,368) (174,515) (3,708,883)

Closing net book value 9,801,407 407,719 10,209,126

As at June 30, 2022

Cost 49,184,461 3,080,920 52,265,381

Accumulated amortization (39,383,054) (2,673,201) (42,056,255)

Net book value 9,801,407 407,719 10,209,126