Page 168 - Pakistan Oilfield Limited - Annual Report 2022

P. 168

166 167

PAKISTAN OILFIELDS LIMITED

Notes to and Forming Part of the

Financial Statements

For the year ended June 30, 2022

2022 2021

Rupees ('000)

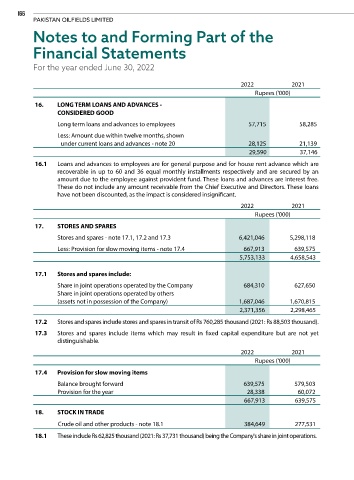

16. LONG TERM LOANS AND ADVANCES -

CONSIDERED GOOD

Long term loans and advances to employees 57,715 58,285

Less: Amount due within twelve months, shown

under current loans and advances - note 20 28,125 21,139

29,590 37,146

16.1 Loans and advances to employees are for general purpose and for house rent advance which are

recoverable in up to 60 and 36 equal monthly installments respectively and are secured by an

amount due to the employee against provident fund. These loans and advances are interest free.

These do not include any amount receivable from the Chief Executive and Directors. These loans

have not been discounted, as the impact is considered insignificant.

2022 2021

Rupees ('000)

17. STORES AND SPARES

Stores and spares - note 17.1, 17.2 and 17.3 6,421,046 5,298,118

Less: Provision for slow moving items - note 17.4 667,913 639,575

5,753,133 4,658,543

17.1 Stores and spares include:

Share in joint operations operated by the Company 684,310 627,650

Share in joint operations operated by others

(assets not in possession of the Company) 1,687,046 1,670,815

2,371,356 2,298,465

17.2 Stores and spares include stores and spares in transit of Rs 760,285 thousand (2021: Rs 88,503 thousand).

17.3 Stores and spares include items which may result in fixed capital expenditure but are not yet

distinguishable.

2022 2021

Rupees ('000)

17.4 Provision for slow moving items

Balance brought forward 639,575 579,503

Provision for the year 28,338 60,072

667,913 639,575

18. STOCK IN TRADE

Crude oil and other products - note 18.1 384,649 277,531

18.1 These include Rs 62,825 thousand (2021: Rs 37,731 thousand) being the Company's share in joint operations.