Page 167 - Pakistan Oilfield Limited - Annual Report 2022

P. 167

164 165

Annual Report 2022

2022 2021

Percentage Amount Percentage Amount

holding Rs ('000) holding Rs ('000)

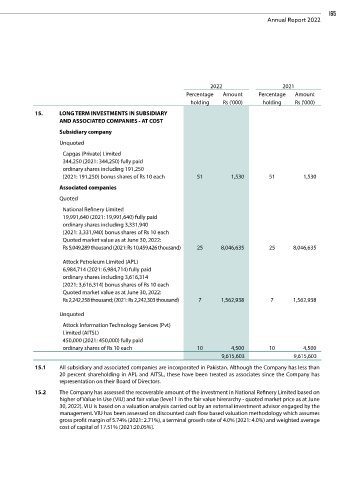

15. LONG TERM INVESTMENTS IN SUBSIDIARY

AND ASSOCIATED COMPANIES - AT COST

Subsidiary company

Unquoted

Capgas (Private) Limited

344,250 (2021: 344,250) fully paid

ordinary shares including 191,250

(2021: 191,250) bonus shares of Rs 10 each 51 1,530 51 1,530

Associated companies

Quoted

National Refinery Limited

19,991,640 (2021: 19,991,640) fully paid

ordinary shares including 3,331,940

(2021: 3,331,940) bonus shares of Rs 10 each

Quoted market value as at June 30, 2022:

Rs 5,049,289 thousand (2021: Rs 10,459,426 thousand) 25 8,046,635 25 8,046,635

Attock Petroleum Limited (APL)

6,984,714 (2021: 6,984,714) fully paid

ordinary shares including 3,616,314

(2021: 3,616,314) bonus shares of Rs 10 each

Quoted market value as at June 30, 2022:

Rs 2,242,258 thousand; (2021: Rs 2,242,303 thousand) 7 1,562,938 7 1,562,938

Unquoted

Attock Information Technology Services (Pvt)

Limited (AITSL)

450,000 (2021: 450,000) fully paid

ordinary shares of Rs 10 each 10 4,500 10 4,500

9,615,603 9,615,603

15.1 All subsidiary and associated companies are incorporated in Pakistan. Although the Company has less than

20 percent shareholding in APL and AITSL, these have been treated as associates since the Company has

representation on their Board of Directors.

15.2 The Company has assessed the recoverable amount of the investment in National Refinery Limited based on

higher of Value In Use (VIU) and fair value (level 1 in the fair value hirerarchy - quoted market price as at June

30, 2022). VIU is based on a valuation analysis carried out by an external investment advisor engaged by the

management. VIU has been assessed on discounted cash flow based valuation methodology which assumes

gross profit margin of 5.74% (2021: 2.71%), a terminal growth rate of 4.0% (2021: 4.0%) and weighted average

cost of capital of 17.51% (2021:20.05%).