Page 233 - Pakistan Oilfield Limited - Annual Report 2022

P. 233

231

Annual Report 2022

Attock Information Technology

National Refinery Limited Attock Petroleum Limited

Services (Pvt) Limited

2022 2021 2022 2021 2022 2021

Rupees ('000) Rupees ('000) Rupees ('000)

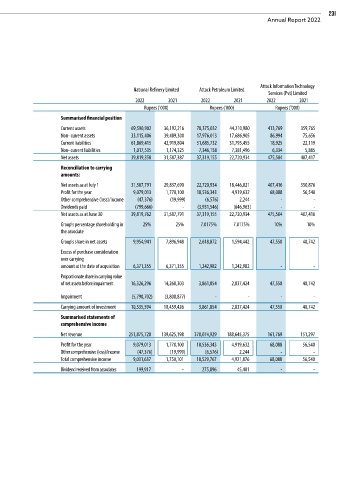

Summarised financial position

Current assets 69,590,902 36,192,216 78,375,032 44,210,980 413,769 359,765

Non- current assets 33,115,406 39,489,300 17,976,013 17,686,905 86,994 75,656

Current liabilities 61,869,415 42,919,804 51,685,732 31,795,455 18,925 22,119

Non- current liabilities 1,017,535 1,174,325 7,346,158 7,381,496 6,334 5,885

Net assets 39,819,358 31,587,387 37,319,155 22,720,934 475,504 407,417

Reconciliation to carrying

amounts:

Net assets as at July 1 31,587,791 29,837,690 22,720,934 18,446,021 407,416 350,876

Profit for the year 9,079,013 1,770,100 18,536,343 4,919,632 68,088 56,540

Other comprehensive (loss)/income (47,376) (19,999) (6,576) 2,244 - -

Dividends paid (799,666) - (3,931,546) (646,963) - -

Net assets as at June 30 39,819,762 31,587,791 37,319,155 22,720,934 475,504 407,416

Group's percentage shareholding in 25% 25% 7.0175% 7.0175% 10% 10%

the associate

Group's share in net assets 9,954,941 7,896,948 2,618,872 1,594,442 47,550 40,742

Excess of purchase consideration

over carrying

amount at the date of acquisition 6,371,355 6,371,355 1,242,982 1,242,982 - -

Proportionate share in carrying value

of net assets before impairment 16,326,296 14,268,303 3,861,854 2,837,424 47,550 40,742

Impairment (5,790,702) (3,808,877) - - - -

Carrying amount of investment 10,535,594 10,459,426 3,861,854 2,837,424 47,550 40,742

Summarised statements of

comprehensive income

Net revenue 251,875,728 139,625,198 370,074,929 188,645,375 161,769 151,297

Profit for the year 9,079,013 1,770,100 18,536,343 4,919,632 68,088 56,540

Other comprehensive (loss)/income (47,376) (19,999) (6,576) 2,244 - -

Total comprehensive income 9,031,637 1,750,101 18,529,767 4,921,876 68,088 56,540

Dividend received from associates 199,917 - 275,896 45,401 - -