Page 235 - Pakistan Oilfield Limited - Annual Report 2022

P. 235

233

Annual Report 2022

2022 2021

Rupees ('000)

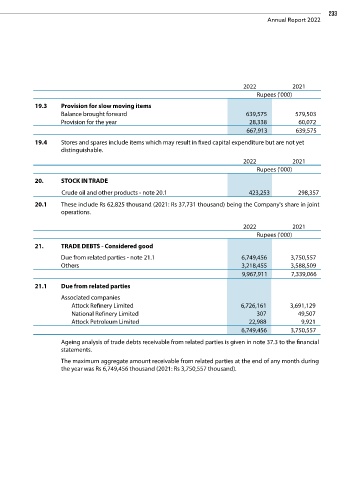

19.3 Provision for slow moving items

Balance brought forward 639,575 579,503

Provision for the year 28,338 60,072

667,913 639,575

19.4 Stores and spares include items which may result in fixed capital expenditure but are not yet

distinguishable.

2022 2021

Rupees ('000)

20. STOCK IN TRADE

Crude oil and other products - note 20.1 423,253 298,357

20.1 These include Rs 62,825 thousand (2021: Rs 37,731 thousand) being the Company's share in joint

operations.

2022 2021

Rupees ('000)

21. TRADE DEBTS - Considered good

Due from related parties - note 21.1 6,749,456 3,750,557

Others 3,218,455 3,588,509

9,967,911 7,339,066

21.1 Due from related parties

Associated companies

Attock Refinery Limited 6,726,161 3,691,129

National Refinery Limited 307 49,507

Attock Petroleum Limited 22,988 9,921

6,749,456 3,750,557

Ageing analysis of trade debts receivable from related parties is given in note 37.3 to the financial

statements.

The maximum aggregate amount receivable from related parties at the end of any month during

the year was Rs 6,749,456 thousand (2021: Rs 3,750,557 thousand).