Page 236 - Pakistan Oilfield Limited - Annual Report 2022

P. 236

234

PAKISTAN OILFIELDS LIMITED

Notes to and Forming Part of the -

Consolidated Financial Statements

For the year ended June 30, 2022

2022 2021

Rupees ('000)

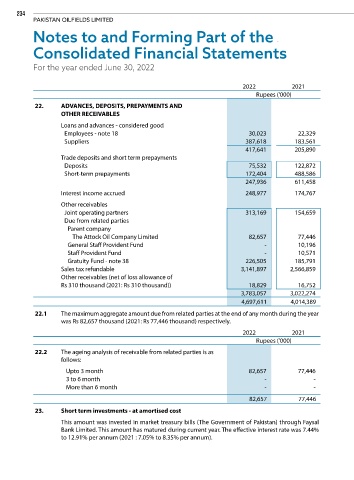

22. ADVANCES, DEPOSITS, PREPAYMENTS AND

OTHER RECEIVABLES

Loans and advances - considered good

Employees - note 18 30,023 22,329

Suppliers 387,618 183,561

417,641 205,890

Trade deposits and short term prepayments

Deposits 75,532 122,872

Short-term prepayments 172,404 488,586

247,936 611,458

Interest income accrued 248,977 174,767

Other receivables

Joint operating partners 313,169 154,659

Due from related parties

Parent company

The Attock Oil Company Limited 82,657 77,446

General Staff Provident Fund - 10,196

Staff Provident Fund - 10,571

Gratuity Fund - note 38 226,505 185,791

Sales tax refundable 3,141,897 2,566,859

Other receivables (net of loss allowance of

Rs 310 thousand (2021: Rs 310 thousand)) 18,829 16,752

3,783,057 3,022,274

4,697,611 4,014,389

22.1 The maximum aggregate amount due from related parties at the end of any month during the year

was Rs 82,657 thousand (2021: Rs 77,446 thousand) respectively.

2022 2021

Rupees ('000)

22.2 The ageing analysis of receivable from related parties is as

follows:

Upto 3 month 82,657 77,446

3 to 6 month - -

More than 6 month - -

82,657 77,446

23. Short term investments - at amortised cost

This amount was invested in market treasury bills (The Government of Pakistan) through Faysal

Bank Limited. This amount has matured during current year. The effective interest rate was 7.44%

to 12.91% per annum (2021 : 7.05% to 8.35% per annum).