Page 252 - Pakistan Oilfield Limited - Annual Report 2022

P. 252

250

PAKISTAN OILFIELDS LIMITED

Notes to and Forming Part of the -

Consolidated Financial Statements

For the year ended June 30, 2022

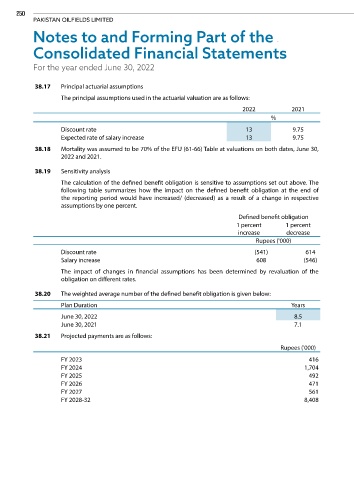

38.17 Principal actuarial assumptions

The principal assumptions used in the actuarial valuation are as follows:

2022 2021

%

Discount rate 13 9.75

Expected rate of salary increase 13 9.75

38.18 Mortality was assumed to be 70% of the EFU (61-66) Table at valuations on both dates, June 30,

2022 and 2021.

38.19 Sensitivity analysis

The calculation of the defined benefit obligation is sensitive to assumptions set out above. The

following table summarizes how the impact on the defined benefit obligation at the end of

the reporting period would have increased/ (decreased) as a result of a change in respective

assumptions by one percent.

Defined benefit obligation

1 percent 1 percent

increase decrease

Rupees ('000)

Discount rate (541) 614

Salary increase 608 (546)

The impact of changes in financial assumptions has been determined by revaluation of the

obligation on different rates.

38.20 The weighted average number of the defined benefit obligation is given below:

Plan Duration Years

June 30, 2022 8.5

June 30, 2021 7.1

38.21 Projected payments are as follows:

Rupees ('000)

FY 2023 416

FY 2024 1,704

FY 2025 492

FY 2026 471

FY 2027 561

FY 2028-32 8,408