Page 253 - Pakistan Oilfield Limited - Annual Report 2022

P. 253

251

Annual Report 2022

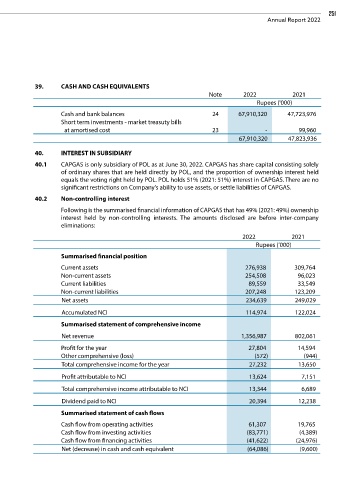

39. CASH AND CASH EQUIVALENTS

Note 2022 2021

Rupees ('000)

Cash and bank balances 24 67,910,320 47,723,976

Short term investments - market treasuty bills

at amortised cost 23 - 99,960

67,910,320 47,823,936

40. INTEREST IN SUBSIDIARY

40.1 CAPGAS is only subsidiary of POL as at June 30, 2022. CAPGAS has share capital consisting solely

of ordinary shares that are held directly by POL, and the proportion of ownership interest held

equals the voting right held by POL. POL holds 51% (2021: 51%) interest in CAPGAS. There are no

significant restrictions on Company's ability to use assets, or settle liabilities of CAPGAS.

40.2 Non-controlling interest

Following is the summarised financial information of CAPGAS that has 49% (2021: 49%) ownership

interest held by non-controlling interests. The amounts disclosed are before inter-company

eliminations:

2022 2021

Rupees (‘000)

Summarised financial position

Current assets 276,938 309,764

Non-current assets 254,508 96,023

Current liabilities 89,559 33,549

Non-current liabilities 207,248 123,209

Net assets 234,639 249,029

Accumulated NCI 114,974 122,024

Summarised statement of comprehensive income

Net revenue 1,356,987 802,061

Profit for the year 27,804 14,594

Other comprehensive (loss) (572) (944)

Total comprehensive income for the year 27,232 13,650

Profit attributable to NCI 13,624 7,151

Total comprehensive income attributable to NCI 13,344 6,689

Dividend paid to NCI 20,394 12,238

Summarised statement of cash flows

Cash flow from operating activities 61,307 19,765

Cash flow from investing activities (83,771) (4,389)

Cash flow from financing activities (41,622) (24,976)

Net (decrease) in cash and cash equivalent (64,086) (9,600)