Page 41 - Condensed Interim Financial Statements - For Nine Months Ended March 31, 2022

P. 41

Notes to and forming part of the Condensed Interim

Consolidated Financial Statements (Unaudited)

For the nine months ended March 31, 2022

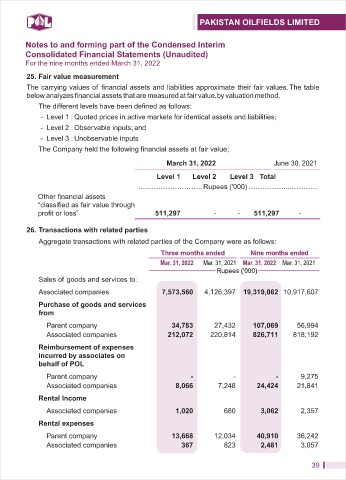

25. Fair value measurement

The carrying values of financial assets and liabilities approximate their fair values. The table

below analyzes financial assets that are measured at fair value, by valuation method.

The different levels have been defined as follows:

- Level 1 : Quoted prices in active markets for identical assets and liabilities;

- Level 2 : Observable inputs; and

- Level 3 : Unobservable inputs

The Company held the following financial assets at fair value;

March 31, 2022 June 30, 2021

Level 1 Level 2 Level 3 Total

…..………………….. Rupees ('000) ……………...…………

Other financial assets

“classified as fair value through

profit or loss” 511,297 - - 511,297 -

26. Transactions with related parties

Aggregate transactions with related parties of the Company were as follows:

Three months ended Nine months ended

Mar. 31, 2022 Mar. 31, 2021 Mar. 31, 2022 Mar. 31, 2021

Rupees ('000)

Sales of goods and services to:

Associated companies 7,573,560 4,126,397 19,319,062 10,917,607

Purchase of goods and services

from

Parent company 34,783 27,432 107,069 56,994

Associated companies 212,072 220,814 826,711 818,192

Reimbursement of expenses

incurred by associates on

behalf of POL

Parent company - - - 9,275

Associated companies 8,066 7,248 24,424 21,841

Rental Income

Associated companies 1,020 680 3,062 2,357

Rental expenses

Parent company 13,668 12,034 40,910 36,242

Associated companies 367 823 2,481 3,057

39