Page 39 - Condensed Interim Financial Statements - For Nine Months Ended March 31, 2022

P. 39

Notes to and forming part of the Condensed Interim

Consolidated Financial Statements (Unaudited)

For the nine months ended March 31, 2022

Based on legal advice, the Company is of the view that already executed Supplemental

Agreement cannot be changed unilaterally, the Supplemental Agreement was signed

under the Conversion Package where gas price was enhanced and Windfall Levy on

Oil/Condensate (WLO) was not applicable, the impugned SRO by giving retrospective

effect amounts to taking away the vested rights already accrued in favour of the Company.

The Government has no authority to give any law or policy a retrospective effect. The

Company filed Constitutional Petition challenging the imposition of WLO on February 19,

2018 against Federation of Pakistan through Ministry of Energy (Petroleum Division),

Islamabad. The Honorable Islamabad High Court after hearing the petitioner on February

20, 2018, directed the parties to maintain the status quo in this respect. After multiple

hearings, the case came up for hearing on March 10, 2022 before the Honourable Chief

Justice of Islamabad High Court, wherein the Chief Justice directed the counsel for

federation to submit a summary of the issue date wise on next date of hearing and

adjourned the case. The next date of hearing has not yet been fixed by the court.

On prudent basis additional revenue (net of sales tax) on account of enhanced gas price

incentive due to conversion from Petroleum Policy 1997 to Petroleum Policy 2012 since

inception to March 31, 2022 amounting to Rs 18,757,516 thousand will be accounted for

upon resolution of this matter (including Rs 16,523,036 thousand related to period since

inception to June 30, 2021). Additional revenue on account of enhanced gas price incentive

of Rs 21,294,475 thousand including sales tax of Rs 3,094,069 thousand received from

customer on the basis of notified prices has been shown under "trade and other payables".

Sales tax of Rs 3,094,069 thousand received from customer on the basis of notified prices

is declared in the monthly sales tax returns as well as duly deposited with Federal Board of

Revenue by the Company. The amount so deposited is shown under "advances, deposits,

prepayments and other receivables".

Three months ended Nine months ended

Mar. 31, 2022 Mar. 31, 2021 Mar. 31, 2022 Mar. 31, 2021

Rupees ('000)

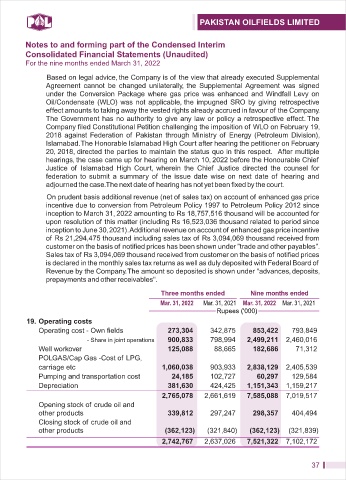

19. Operating costs

Operating cost - Own fields 273,304 342,875 853,422 793,849

- Share in joint operations 900,833 798,994 2,499,211 2,460,016

Well workover 125,088 88,665 182,686 71,312

POLGAS/Cap Gas -Cost of LPG,

carriage etc 1,060,038 903,933 2,838,129 2,405,539

Pumping and transportation cost 24,185 102,727 60,297 129,584

Depreciation 381,630 424,425 1,151,343 1,159,217

2,765,078 2,661,619 7,585,088 7,019,517

Opening stock of crude oil and

other products 339,812 297,247 298,357 404,494

Closing stock of crude oil and

other products (362,123) (321,840) (362,123) (321,839)

2,742,767 2,637,026 7,521,322 7,102,172

37