Page 36 - Condensed Interim Financial Statements - For Nine Months Ended March 31, 2022

P. 36

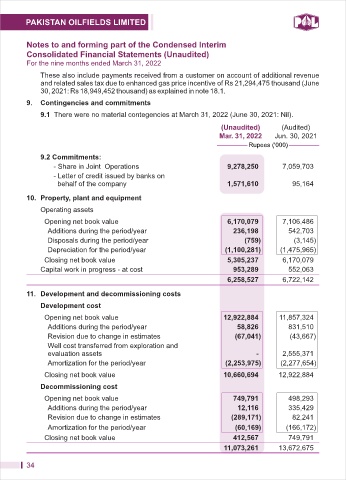

Notes to and forming part of the Condensed Interim

Consolidated Financial Statements (Unaudited)

For the nine months ended March 31, 2022

These also include payments received from a customer on account of additional revenue

and related sales tax due to enhanced gas price incentive of Rs 21,294,475 thousand (June

30, 2021: Rs 18,949,452 thousand) as explained in note 18.1.

9. Contingencies and commitments

9.1 There were no material contegencies at March 31, 2022 (June 30, 2021: Nil).

(Unaudited) (Audited)

Mar. 31, 2022 Jun. 30, 2021

Rupees ('000)

9.2 Commitments:

- Share in Joint Operations 9,278,250 7,059,703

- Letter of credit issued by banks on

behalf of the company 1,571,610 95,164

10. Property, plant and equipment

Operating assets

Opening net book value 6,170,079 7,106,486

Additions during the period/year 236,198 542,703

Disposals during the period/year (759) (3,145)

Depreciation for the period/year (1,100,281) (1,475,965)

Closing net book value 5,305,237 6,170,079

Capital work in progress - at cost 953,289 552,063

6,258,527 6,722,142

11. Development and decommissioning costs

Development cost

Opening net book value 12,922,884 11,857,324

Additions during the period/year 58,826 831,510

Revision due to change in estimates (67,041) (43,667)

Well cost transferred from exploration and

evaluation assets - 2,555,371

Amortization for the period/year (2,253,975) (2,277,654)

Closing net book value 10,660,694 12,922,884

Decommissioning cost

Opening net book value 749,791 498,293

Additions during the period/year 12,116 335,429

Revision due to change in estimates (289,171) 82,241

Amortization for the period/year (60,169) (166,172)

Closing net book value 412,567 749,791

11,073,261 13,672,675

34