Page 37 - Condensed Interim Financial Statements - For Nine Months Ended March 31, 2022

P. 37

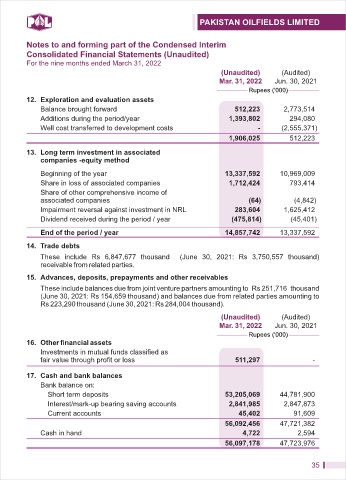

Notes to and forming part of the Condensed Interim

Consolidated Financial Statements (Unaudited)

For the nine months ended March 31, 2022

(Unaudited) (Audited)

Mar. 31, 2022 Jun. 30, 2021

Rupees ('000)

12. Exploration and evaluation assets

Balance brought forward 512,223 2,773,514

Additions during the period/year 1,393,802 294,080

Well cost transferred to development costs - (2,555,371)

1,906,025 512,223

13. Long term investment in associated

companies -equity method

Beginning of the year 13,337,592 10,969,009

Share in loss of associated companies 1,712,424 793,414

Share of other comprehensive income of

associated companies (64) (4,842)

Impairment reversal against investment in NRL 283,604 1,625,412

Dividend received during the period / year (475,814) (45,401)

End of the period / year 14,857,742 13,337,592

14. Trade debts

These include Rs 6,847,677 thousand (June 30, 2021: Rs 3,750,557 thousand)

receivable from related parties.

15. Advances, deposits, prepayments and other receivables

These include balances due from joint venture partners amounting to Rs 251,716 thousand

(June 30, 2021: Rs 154,659 thousand) and balances due from related parties amounting to

Rs 223,290 thousand (June 30, 2021: Rs 284,004 thousand).

(Unaudited) (Audited)

Mar. 31, 2022 Jun. 30, 2021

Rupees ('000)

16. Other financial assets

Investments in mutual funds classified as

fair value through profit or loss 511,297 -

17. Cash and bank balances

Bank balance on:

Short term deposits 53,205,069 44,781,900

Interest/mark-up bearing saving accounts 2,841,985 2,847,873

Current accounts 45,402 91,609

56,092,456 47,721,382

Cash in hand 4,722 2,594

56,097,178 47,723,976

35