Page 161 - Pakistan Oilfields Limited - Annual Report 2021

P. 161

NOTES TO AND FORMING

PART OF THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2021

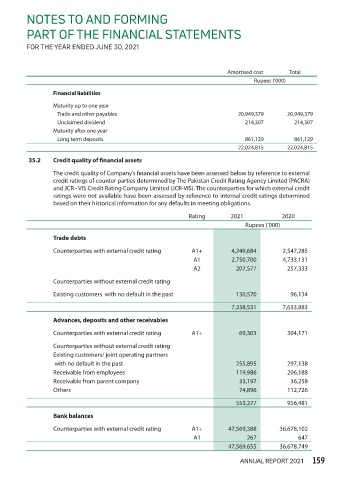

Amortised cost Total

Rupees ('000)

Financial liabilities

Maturity up to one year

Trade and other payables 20,949,379 20,949,379

Unclaimed dividend 214,307 214,307

Maturity after one year

Long term deposits 861,129 861,129

22,024,815 22,024,815

35.2 Credit quality of financial assets

The credit quality of Company’s financial assets have been assessed below by reference to external

credit ratings of counter parties determined by The Pakistan Credit Rating Agency Limited (PACRA)

and JCR - VIS Credit Rating Company Limited (JCR-VIS). The counterparties for which external credit

ratings were not available have been assessed by reference to internal credit ratings determined

based on their historical information for any defaults in meeting obligations.

Rating 2021 2020

Rupees ('000)

Trade debts

Counterparties with external credit rating A1+ 4,249,684 2,547,285

A1 2,750,700 4,733,131

A2 207,577 257,333

Counterparties without external credit rating

Existing customers with no default in the past 130,570 96,134

7,338,531 7,633,883

Advances, deposits and other receivables

Counterparties with external credit rating A1+ 69,303 304,171

Counterparties without external credit rating

Existing customers/ joint operating partners

with no default in the past 255,895 297,138

Receivable from employees 119,986 206,188

Receivable from parent company 33,197 36,258

Others 74,896 112,726

553,277 956,481

Bank balances

Counterparties with external credit rating A1+ 47,569,388 36,678,102

A1 267 647

47,569,655 36,678,749

ANNUAL REPORT 2021 159