Page 201 - Pakistan Oilfields Limited - Annual Report 2021

P. 201

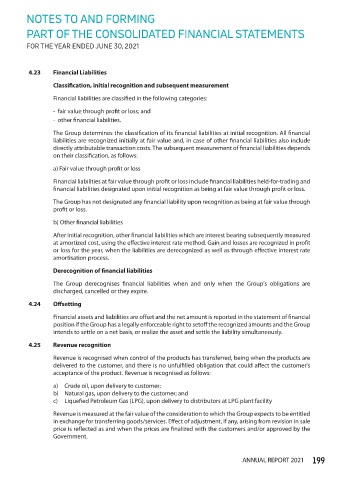

NOTES TO AND FORMING

PART OF THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2021

4.23 Financial Liabilities

Classification, initial recognition and subsequent measurement

Financial liabilities are classified in the following categories:

- fair value through profit or loss; and

- other financial liabilities.

The Group determines the classification of its financial liabilities at initial recognition. All financial

liabilities are recognized initially at fair value and, in case of other financial liabilities also include

directly attributable transaction costs. The subsequent measurement of financial liabilities depends

on their classification, as follows:

a) Fair value through profit or loss

Financial liabilities at fair value through profit or loss include financial liabilities held-for-trading and

financial liabilities designated upon initial recognition as being at fair value through profit or loss.

The Group has not designated any financial liability upon recognition as being at fair value through

profit or loss.

b) Other financial liabilities

After initial recognition, other financial liabilities which are interest bearing subsequently measured

at amortized cost, using the effective interest rate method. Gain and losses are recognized in profit

or loss for the year, when the liabilities are derecognized as well as through effective interest rate

amortisation process.

Derecognition of financial liabilities

The Group derecognises financial liabilities when and only when the Group's obligations are

discharged, cancelled or they expire.

4.24 Offsetting

Financial assets and liabilities are offset and the net amount is reported in the statement of financial

position if the Group has a legally enforceable right to setoff the recognized amounts and the Group

intends to settle on a net basis, or realize the asset and settle the liability simultaneously.

4.25 Revenue recognition

Revenue is recognised when control of the products has transferred, being when the products are

delivered to the customer, and there is no unfulfilled obligation that could affect the customer's

acceptance of the product. Revenue is recognised as follows:

a) Crude oil, upon delivery to customer;

b) Natural gas, upon delivery to the customer; and

c) Liquefied Petroleum Gas (LPG), upon delivery to distributors at LPG plant facility

Revenue is measured at the fair value of the consideration to which the Group expects to be entitled

in exchange for transferring goods/services. Effect of adjustment, if any, arising from revision in sale

price is reflected as and when the prices are finalized with the customers and/or approved by the

Government.

ANNUAL REPORT 2021 199